To be considered “rich”, or in the top 1% of wealth for Americans, you should have approximately $10 million. Broken down by age, here is what is required by age to make it into the Top 1% of Wealth in America.

Furthermore, Can you retire 2 million?

It’s an important question to ask. Yes, for some people, $2 million should be more than enough to retire. For others, $2 million may not even scratch the surface. The answer depends on your personal situation and there are lot of challenges you’ll face.

Then, What salary is upper class? An upper class income is usually considered at least 50% higher than the median household income. Therefore, an upper class income in America is $100,000 and higher.

What should net worth be at 40? Net Worth at Age 40

By age 40, your goal is to have a net worth of two times your annual salary. So, if your salary edges up to $80,000 in your 30s, then by age 40 you should strive for a net worth of $160,000. Additionally, it’s not just contributing to retirement that helps you build your net worth.

Therefore, What should net worth be at 25? The Average Net Worth At Age 25

According to CNN Money, the average net worth for the following ages in 2022 are: $9,000 for ages 25-34. $52,000 for ages 35-44, $100,000 for ages 45-54. $180,000 for ages 55-64.

What net worth is considered wealthy?

The average net worth needed to be considered wealthy and to be financially comfortable both rose from last year’s survey. In 2021, Americans said they needed $624,000 in net assets to live comfortably, while it would take $1.9 million to be rich.

Can I retire at 55 with 2. 5 million?

Yes, you can retire at 55 with 2 million dollars. At age 55, an annuity will provide a guaranteed level income of $84,000 annually starting immediately, for the rest of the insured’s lifetime. The income will stay the same and never decrease.

How do millionaires live off interest?

Examples of cash equivalents are money market mutual funds, certificates of deposit, commercial paper and Treasury bills. Some millionaires keep their cash in Treasury bills that they keep rolling over and reinvesting. They liquidate them when they need the cash.

How many Americans make over $100000 per year?

About 30.7% of households earned over $100,000 in 2020. In 2019, around 15.5% of Americans earned between $100,000 and $149,999; about 8.3% of the population earned between $150,000 and $199,999; and about 10.3% of the population earned over $200,000.

What qualifies as rich?

Compared to 2021 standards, respondents to the 2020 survey described the threshold for wealth as being a net worth of $2.6 million.

How much is rich in America?

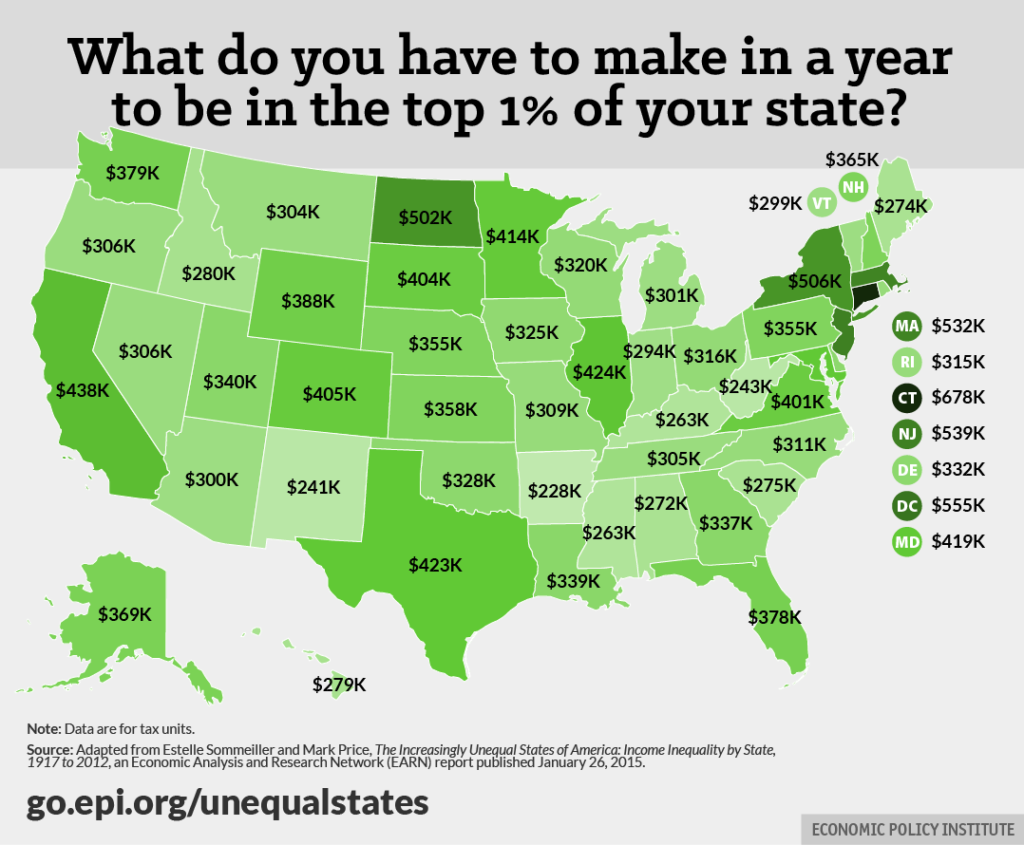

How much more than average income would be considered “rich?” One common indicator is being in the nation’s “top 1%” of earners. According to the Economic Policy Institute Opens in new window, those include Americans who earn at least $421,926 a year—but their average annual income is far higher: $1,316,985.

How much should a 35 year old have saved?

By the time you are 35, you should have at least 4X your annual expenses saved up. Alternatively, you should have at least 4X your annual expenses as your net worth. In other words, if you spend $60,000 a year to live at age 35, you should have at least $240,000 in savings or have at least a $240,000 net worth.

How much does the average 35 year old have saved?

Average savings by age

| Age group | Average savings balance |

|---|---|

| Under 35 | $11,200 |

| 35-44 | $27,900 |

| 45-54 | $48,200 |

| 55-64 | $57,800 |

• Mar 23, 2022

How much should a 30 year old have in savings?

You’ll find that one retirement-savings benchmark gets the most airtime: It comes from Fidelity Investments and says you should have an amount equal to your annual salary saved by age 30.

How much should a 22 year old have saved?

The general rule of thumb is that you should save 20% of your salary for retirement, emergencies, and long-term goals. By age 21, assuming you have worked full time earning the median salary for the equivalent of a year, you should have saved a little more than $6,000.

How much money do most 30 year olds have?

The average net worth for a 30 year old American is roughly $8,000 in 2022. But for the above-average 30 year old, his or her net worth is closer to $250,000. The discrepancy lies in education, saving rate, investment returns, consistency, and income.

How much does the average 21 year old make?

Average Salary for Ages 20-24

The median salary of 20- to 24-year-olds is $667 per week, which translates to $34,684 per year. Many Americans start out their careers in their 20s and don’t earn as much as they will once they reach their 30s.

What percent of Americans have a net worth of $1000000?

A new survey has found that there are 13.61 million households that have a net worth of $1 million or more, not including the value of their primary residence. That’s more than 10% of households in the US. So the US is definitely the country with the most millionaires.

What percentage of U.S. population has $3 million dollars?

But the median net worth of Americans is $121,700. Now onto the real question. Currently, there are approximately 5,671,005 households in the US that have more than $3 million– the value accounts for up to 4.41% of all US households.

Are you rich with 2 million dollars?

Respondents to Schwab’s 2021 Modern Wealth Survey said a net worth of $1.9 million qualifies a person as wealthy. The average net worth of U.S. households, however, is less than half of that.

What is a good monthly retirement income?

According to AARP, a good retirement income is about 80 percent of your pre-tax income prior to leaving the workforce. This is because when you’re no longer working, you won’t be paying income tax or other job-related expenses.

Will Social Security run out?

Myth #1: Social Security is going broke

The facts: As long as workers and employers pay payroll taxes, Social Security will not run out of money.

Can a bank refuse to give you your money?

If a bank thinks your account might be at risk for fraud or someone stealing your money, they’re allowed to flag the account and take reasonable steps to protect your money. BUT – they can’t just lock you out forever. If you tell them to give you your money back and they won’t, EFTA may let you sue.

Why you shouldn’t keep money in the bank?

The problem is that when interest rates — what the bank pays you in exchange for making a deposit — is lower than inflation — the rate at which money loses value — that means your money is actually worth LESS in the future than it is now.

Is it smart to keep all your money in one bank?

Keeping all of your accounts at a single bank just makes life simpler. It means that … And let’s not forget that keeping all of your accounts at the same bank means that the institution has more of an incentive to develop a great relationship with you.