This could enable you to make money online and get paid for your time outside of a full-time job. Patreon is a crowdfunding platform that allows fans of content creators to demonstrate their support. Some Patreon creators have been successful enough to rake in $200,000 per year through the site.

Accordingly, How do I run a successful Patreon?

How to Launch a World-Class Patreon Campaign

- Create an Attractive Profile.

- Offer Tantalizing Patron Rewards.

- Set Achievable Goals.

- Thank Your Patrons.

- Promote, Promote, Promote.

- Create Quality Content.

as well, Do you need a business license for Patreon? Your Patreon income does not require you to register as an LLC but there are many reasons you should consider it. Setting up an LLC can protect your personal assets from the majority of liabilities incurred by your business.

How do you get noticed on Patreon? 13 Ways to Get More Patrons on Patreon

- Focus on The Benefits For Patrons.

- Create More Reward Tiers on Patreon.

- Multiple Funding Goals Create Momentum.

- Have Consistent Content and Communication.

- Host Live Videos and Livestreams.

- Limited Quantity Reward Tiers.

- Build an Email List.

- 8. Facebook Advertising.

So, Do you have to file taxes for Patreon? Patreon is required by law to add sales tax, or VAT, or other similar taxes, to some patron payments. Tax laws in many countries and US states have evolved in recent years to require “online marketplaces” as well as video and audio streaming companies to apply sales tax to transactions.

Can anyone set up a Patreon?

Anyone can use Patreon as a source of revenue. It has no up-front costs, and there are just a few things you need to make it successful.

How do I start a Patreon business?

Visit patreon.com and click on the Create on Patreon button at the top right corner. You can also click on our Starter kits link to browse templated pages to expedite your launch process– we have templates for podcasters, writers video creators, and more! From here, you can sign up with Facebook, Google, or your email.

How is Patreon money taxed?

Does Patreon withhold any taxes from my payments? No – Patreon doesn’t withhold anything (aside from our fees) from your funds earned on Patreon. We are obligated to add, collect, and remit sales tax and VAT on top of some pledge, but those funds are not calculated anywhere as ‘earnings’.

Do you need a business bank account for Patreon?

You will need a bank account to get paid. We do use three very popular payment services to get the money to you, but you must have a bank account to receive the money. The different services may not work in your country, or you may have heard that you can get a payout via a credit or debit card rather than a bank.

Can a company use Patreon?

Absolutely! Many creators on Patreon set up private channels on Facebook, Discord, website forums, subreddits, and more. Doing so adds value to what you offer, while often taking work off your shoulders as fans will jump in to answer each other’s questions.

How do I get people to buy my Patreon?

9 Tips to get more Patreon supporters

- To give you a bit of context….

- #1 Don’t ever ask directly.

- #2 Mention your Patreon page everywhere.

- #3 Use different content.

- #4 Make it personal.

- #5 Use incentives for new sign-ups.

- #6 Giveaways are great.

- #7 Build a community.

Can you promote Patreon on Instagram?

Well, the easiest way to promote Patreon on Instagram is to add your Patreon link to your Instagram bio. This is really easy! All you have to do is to click on your profile icon on Patreon and click on the “Finish Page” button. Then, below the “Basics” section, scroll down and find “Patreon Page URL”.

Where can I promote my Patreon?

Reach your fans where they engage the most with you (Twitter, Instagram, Discord, Reddit, Facebook…) and let them know about the limited time benefit. You’re likely posting there already, so make sure to promote your special offer and renew interest in your Patreon program. 5.

Is Patreon considered a donation?

Your contribution, minus the value of any thank-you gifts you receive, is tax-deductible to the full extent provided by law. For example, if the patron pays $100, of which $20 is the deemed value of a tote bag, then only the $80 is considered to be tax-deductible.

Does Patreon take taxes automatically?

Does Patreon withhold any taxes from my payments? No – Patreon doesn’t withhold anything (aside from our fees) from your funds earned on Patreon. We are obligated to add, collect, and remit sales tax and VAT on top of some pledge, but those funds are not calculated anywhere as ‘earnings’.

Is Patreon safe?

For a subscriber, Patreon is perfectly safe to use. This is a trusted, professional company that is motivated to help artists and other creatives to be able to afford to focus on their projects. Subscribers get to choose between three levels of subscription. The lowest-priced tier will be your basic subscription.

Do I have to pay taxes on my Patreon income?

One, your Patreon earnings are taxable income unless you’re a qualified nonprofit, so you should report all Patreon income on your tax returns.

Is Patreon considered income?

Is the money I earned from Patreon “taxable income”? In many jurisdictions, the money you receive from your patrons is considered taxable income. If you are a legally recognized not-for-profit company (for example, a USA 501(C)(3) charity), then you might not need to pay tax on your Patreon funds.

How do I grow my Patreon?

9 Tips to get more Patreon supporters

- To give you a bit of context….

- #1 Don’t ever ask directly.

- #2 Mention your Patreon page everywhere.

- #3 Use different content.

- #4 Make it personal.

- #5 Use incentives for new sign-ups.

- #6 Giveaways are great.

- #7 Build a community.

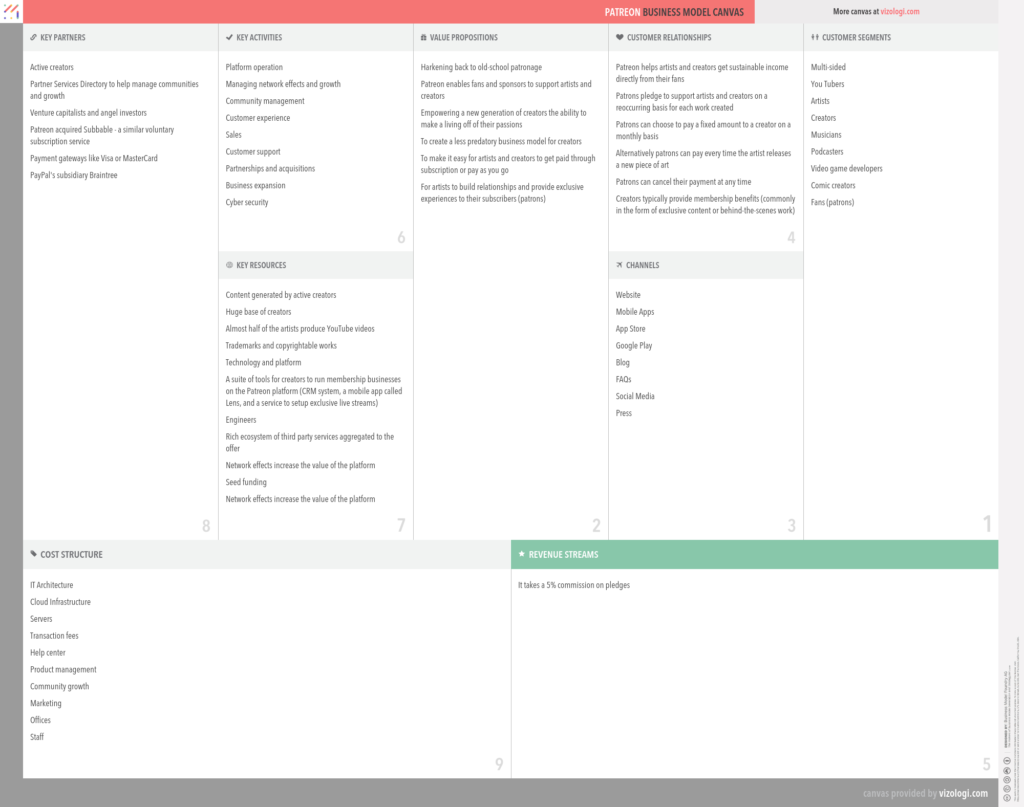

What company owns Patreon?

It allows artists to receive funding directly from their fans, or patrons, on a recurring basis or per work of art. The company is based in San Francisco.

Patreon.

| Screenshot A Patreon page from January 20, 2018 | |

|---|---|

| Headquarters | San Francisco, California , U.S. |

| Created by | Jack Conte Sam Yam |

| Key people | Jack Conte (CEO) |

How much does Patreon cost per month?

On top of the platform fee, the payment processor (Stripe or PayPal) charges a fee for each donation made: 2.9% + $0.30 for donations over $3.

Terms & Fees.

| Funding Duration | Unlimited/Continuous |

|---|---|

| Funding Method | Per month OR per creation |

| Platform Fee | 5%-12% |

| Payment Processing Fee | 2.9% + $0.30 for donations over $3 |

May 21, 2021

What can I sell on Patreon?

Patreon is a subscription membership based crowdfunding website. It’s a place where creative small business people can offer paying patrons special access to content of all types. It’s designed specifically for creative people like podcasters, musicians, video creators, writers and others.

What do Patreon people do?

Patreon lets people financially support and reward content creators — such as podcasters, writers, and YouTubers — through a monthly subscription. Creators can set up multiple membership tiers with various rewards so each subscriber can choose the amount of money they feel most comfortable giving to a project.

Is Patreon a self employed job?

Patreon income is subject to self-employment tax in most cases.

Is Patreon charitable?

However, for creators who are legally recognized as 501(c)(3) charities, their patrons can use the charitable deduction for their contributions. Many creators offer special benefits for different levels of contribution. This feature of Patreon can make the “charitable donations” classification problematic.

Does Patreon send me a 1099?

Patreon will provide one 1099-K per page, not per taxable identity. For example, if you have two pages with the same tax information on your W-9 and one of your pages met the earnings threshold, we’ll generate a 1099-K for that page and report the earnings from that page.