How to calculate profit margin

- Find out your COGS (cost of goods sold). …

- Find out your revenue (how much you sell these goods for, for example $50 ).

- Calculate the gross profit by subtracting the cost from the revenue. …

- Divide gross profit by revenue: $20 / $50 = 0.4 .

- Express it as percentages: 0.4 * 100 = 40% .

Accordingly, How do you find profit margin from sales?

Divide the total profit by the total income to find the sales margin as a decimal. In the toothpaste example, divide the profit of $1.80 by the income of $3 to get a sales margin of 0.6. Alternatively, divide $270,000 by $600,000 to find the annual overall sales margin is 0.45.

as well, What is the formula to calculate profit? Finding profit is simple using this formula: Total Revenue – Total Expenses = Profit.

How do I calculate margin and markup? To calculate markup subtract your product cost from your selling price. Then divide that net profit by the cost. To calculate margin, divide your product cost by the retail price.

So, How do you calculate net profit margin percentage? Formula and Calculation for Net Profit Margin

On the income statement, subtract the cost of goods sold (COGS), operating expenses, other expenses, interest (on debt), and taxes payable. Divide the result by revenue. Convert the figure to a percentage by multiplying it by 100.

How do you calculate small business profit?

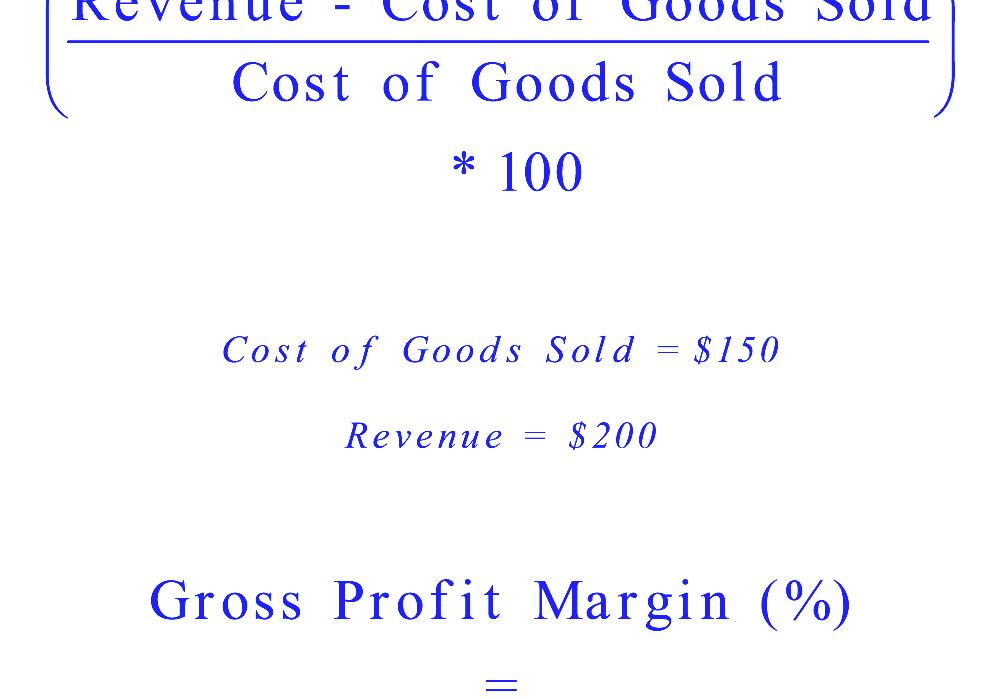

To calculate the Gross Profit Margin for your startup or small business, take the revenue and minus the direct costs of producing your product. Divide this by the revenue. The resulting number is multiplied by 100 and the answer is expressed as a percentage. This is your Gross Profit Margin.

How do you find profit margin with cost and selling price?

Subtract the cost from the sale price to get profit margin, and divide the margin into the sale price for the profit margin percentage. For example, you sell a product for $100 that costs your business $60. The profit margin is $40 – or 40 percent of the selling price.

How do you calculate profit markup?

The markup formula is as follows: markup = 100 * profit / cost . We multiply by 100 because we express it as a percentage, not as a fraction (25% is the same as 0.25 or 1/4 or 20/80). This is a simple percent increase formula.

How do you calculate margin from cost?

Margin Definition

Margin (also known as gross margin) is sales minus the cost of goods sold. For example, if a product sells for $100 and costs $70 to manufacture, its margin is $30. Or, stated as a percentage, the margin percentage is 30% (calculated as the margin divided by sales).

How do I calculate profit margin in Excel?

The formula should divide the profit by the amount of the sale, or =(C2/A2)100 to produce a percentage. In the example, the formula would calculate (17/25)100 to produce 68 percent profit margin result.

How do you calculate margin on a product?

The difference between the selling price and the product cost gives the product’s gross profit margin. To obtain the product margin, the gross profit margin is divided by the selling price. Product margin= (selling price – cost of product) / selling price.

How do you calculate profit margin quizlet?

The equation to calculate net profit margin is: net margin = net profit / revenue.

What is a profitable margin?

Profit margin indicates the profitability of a product, service, or business. It’s expressed as a percentage; the higher the number, the more profitable the business.

What is the formula to calculate selling price?

How to Calculate Selling Price Per Unit

- Determine the total cost of all units purchased.

- Divide the total cost by the number of units purchased to get the cost price.

- Use the selling price formula to calculate the final price: Selling Price = Cost Price + Profit Margin.

How do you calculate profit markup?

Profit = revenue – cost . So the markup formula becomes: markup = 100 * (revenue – cost) / cost . And finally, if you need the selling price, then try revenue = cost + cost * markup / 100 .

What do you mean by profit margin?

Profit margin gauges the degree to which a company or a business activity makes money, essentially by dividing income by revenues. Expressed as a percentage, profit margin indicates how many cents of profit has been generated for each dollar of sale.

How does a company calculate net profit?

Since net profit equals total revenue after expenses, to calculate net profit, you just take your total revenue for a period of time and subtract your total expenses from that same time period. Here’s an example: An ecommerce company has $350,000 in revenue with a cost of goods sold of $50,000.

What is profit margin quizlet?

Profit margin measures the extent by which selling price covers all expenses.

What is formula of profit and loss?

What is the profit and loss formula? The formula for profit = Selling price – Cost price. Profit % = (Profit/Cost price) x 100. The formula for loss = Cost price – Selling price. Loss % = (Loss/Cost price) x 100.

What is a good margin of profit?

But in general, a healthy profit margin for a small business tends to range anywhere between 7% to 10%. Keep in mind, though, that certain businesses may see lower margins, such as retail or food-related companies.

What is a good profit margin for a product?

You may be asking yourself, “what is a good profit margin?” A good margin will vary considerably by industry, but as a general rule of thumb, a 10% net profit margin is considered average, a 20% margin is considered high (or “good”), and a 5% margin is low.

What is a good net profit margin?

An NYU report on U.S. margins revealed the average net profit margin is 7.71% across different industries. But that doesn’t mean your ideal profit margin will align with this number. As a rule of thumb, 5% is a low margin, 10% is a healthy margin, and 20% is a high margin.

What does a 10 profit margin mean?

10 or 10 percent, meaning that each dollar of sales generated an average of ten cents of profit. Thus, the profit margin is very important as a measure of the competitive success of a business, because it captures the firm’s unit costs. A low-cost producer in an industry would generally have a higher profit margin.

What is the difference between the profit margin and the gross profit rate quizlet?

The gross profit rate is computed by dividing net sales by gross profit and the profit margin is computed by dividing net sales by net income. The gross profit rate will normally be higher than the profit margin ratio. The gross profit rate will normally be higher than the profit margin ratio.

Do you want a high gross profit margin?

A higher profit margin is always desirable since it means the company generates more profits from its sales. However, profit margins can vary by industry. Growth companies might have a higher profit margin than retail companies, but retailers make up for their lower profit margins with higher sales volumes.

How do you calculate profit and loss in Excel?

The Excel Profit Margin Formula is the amount of profit divided by the amount of the sale or (C2/A2)100 to get value in percentage. Example: Profit Margin Formula in Excel calculation (120/200)100 to produce a 60 percent profit margin result.