What is LTV? Lifetime Value (LTV) is the lifetime spend of customers in aggregate. LTV is an aggregate metric, unlike CLV, which is calculated at the individual customer level.

Accordingly, What is the CLV formula?

Customer Lifetime Value is calculated by multiplying your customers’ average purchase value, average purchase frequency, and average customer lifespan.

as well, What is a good CLV? Generally speaking, your Customer Lifetime Value should be at least three times greater than your Customer Acquisition Cost (CAC). In other words, if you’re spending $100 on marketing to acquire a new customer, that customer should have an LTV of at least $300.

What is your LTV customer lifetime value? What is Customer Lifetime Value (LTV)? The customer lifetime value (LTV), also known as lifetime value, is the total revenue. In accounting, the terms sales and a company expects to earn over the lifetime of their relationship with a single customer.

So, What is CLV used for? CLV will help you find balance in terms of short-term and long-term marketing goals and demonstrate a better understanding of financial return on your investments. CLV encourages better decision making by teaching marketers to spend less time acquiring customers with lower value.

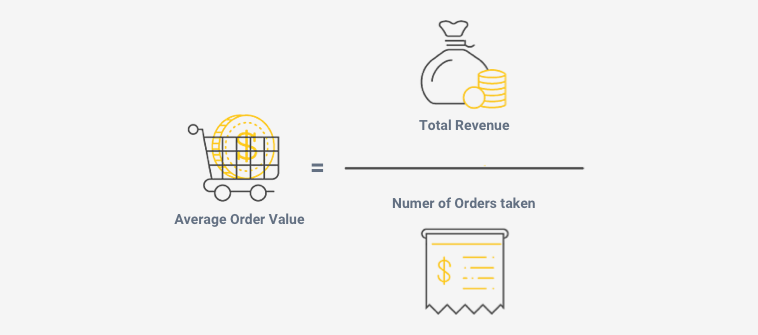

How is CLTV calculated?

Customer Lifetime Value = (Customer Value * Average Customer Lifespan) To find CLTV, you need to calculate the average purchase value and then multiply that number by the average number of purchases to determine customer value.

Why LTV is important?

LTV is important because lenders use it when considering whether to approve a loan and/or what terms to offer a borrower. The higher the LTV, the higher the risk for the lender—if the borrower defaults, the lender is less likely to be able to recoup their money by selling the house.

How is LTV calculated?

Understanding the Loan-to-Value (LTV) Ratio

An LTV ratio is calculated by dividing the amount borrowed by the appraised value of the property, expressed as a percentage. For example, if you buy a home appraised at $100,000 for its appraised value, and make a $10,000 down payment, you will borrow $90,000.

What is the difference between CLTV and LTV?

The loan to value (LTV) ratio of a mortgage is the ratio of the mortgage balance to the value of the property, while the combined loan to value (CLTV) is the same calculation made for the sum of all loans taken out on the property.

What does 80% CLTV mean?

The CLTV ratio is determined by adding the balances of all outstanding loans and dividing by the current market value of the property. For example, a property with a first mortgage balance of $300,000, a second mortgage balance of $100,000 and a value of $500,000 has a CLTV ratio of 80%.

How is CLTV calculated in home loan?

Calculating your loan-to-value ratio

- Current loan balance ÷ Current appraised value = LTV.

- Example: You currently have a loan balance of $140,000 (you can find your loan balance on your monthly loan statement or online account).

- $140,000 ÷ $200,000 = .70.

- Current combined loan balance ÷ Current appraised value = CLTV.

What does 60% LTV mean?

What does LTV mean? Your “loan to value ratio” (LTV) compares the size of your mortgage loan to the value of the home. For example: If your home is worth $200,000, and you have a mortgage for $180,000, your LTV ratio is 90% — because the loan makes up 90% of the total price.

Is a 40% LTV good?

What Is a Good LTV? If you’re taking out a conventional loan to buy a home, an LTV ratio of 80% or less is ideal. Conventional mortgages with LTV ratios greater than 80% typically require PMI, which can add tens of thousands of dollars to your payments over the life of a mortgage loan.

What is the best LTV ratio?

As a general rule of thumb, your ideal loan to value ratio should be somewhere under 80%. Anything above 80% is considered a high LTV – there are plenty of mortgages available for people with LTVs at 80, 90 or even 95%, but you’ll be paying much more on interest.

How do you calculate LTV lifetime value?

In the simplest form, LTV equals Lifetime Customer Revenue minus Lifetime Customer Costs. Using a simple example, if a customer purchases $1,000 worth of products or services from your business over the lifetime of your relationship, and the total cost of sales and service to the customer is $500, then the LTV is $500.

How is combined loan to value CLTV calculated?

To calculate the combined loan-to-value ratio, divide the aggregate principal balances of all loans by the property’s purchase price or fair market value. The CLTV ratio is thus determined by dividing the sum of the items listed below by the lesser of the property’s sales price or the appraised value of the property.

What is the importance of LTV CLTV for a mortgage loan?

Lenders use the CLTV ratio to determine a prospective home buyer’s risk of default when more than one loan is used—for example, if they will have two or more mortgages, or a mortgage plus a home equity loan or line of credit (HELOC).

How is combined loan-to-value Cltv calculated?

To calculate the combined loan-to-value ratio, divide the aggregate principal balances of all loans by the property’s purchase price or fair market value. The CLTV ratio is thus determined by dividing the sum of the items listed below by the lesser of the property’s sales price or the appraised value of the property.

How do you calculate 80% LTV?

Loan to value is the ratio of the amount of the mortgage lien divided by the appraisal value of a property. If you put 20% down on a $200,000 home that $40,000 payment would mean the home still has $160,000 of debt against it, giving it a LTV of 80%.

What is LTV CLTV and Hcltv?

LTV, CLTV and HCLTV

– LTV = (Loan to value) = Original loan amount divided by lesser of sales price. or appraised value for purchase transactions* – CLTV = (Combined loan to value) = Original loan amount, the drawn portion. (outstanding principal balance) of a HELOC and the unpaid principal balance.

What is a good LTV for refinance?

The rule of thumb is that your LTV ratio should be 80% or lower to refinance. This means you have at least 20% equity in your home. You may be able to refinance with a higher ratio, though, especially if you have a very good credit score.

What does APRC mean?

APRC stands for Annual Percentage Rate of Charge. A lender is always required to quote the APRC when advertising a loan or borrowing rate. It is a standard interest rate calculation designed to reflect the total amount of interest that will be paid over the entire period of the loan.

What is Cltv?

The combined loan-to-value (CLTV) ratio is the ratio of all secured loans on a property to the value of a property. Lenders use the CLTV ratio to determine a prospective home buyer’s risk of default when more than one loan is used.

What is APRC?

APRC stands for Annual Percentage Rate of Charge, and should not be confused with APR. It shows you the total cost of a mortgage, including fees, over the entire term of the loan (usually 25 to 30 years).

What are the LTV bands?

Most will offer a range of two or three LTV bands – perhaps between 80% and 95% LTV, between 60% and 80% LTV, and below 60% LTV, for example. But across the market in general, you can probably find mortgages on offer above 95% LTV and then in multiples of 5% increments (90% LTV, 85%, 80% and so on).

What does 70% LTV mean?

You should see “0.7,” which translates to 70% LTV. That’s it, all done! This means our hypothetical borrower has a loan for 70 percent of the purchase price or appraised value, with the remaining 30 percent the home equity portion, or actual ownership in the property.

What is considered a high mortgage?

The 35% / 45% model. With the 35% / 45% model, your total monthly debt, including your mortgage payment, shouldn’t be more than 35% of your pre-tax income, or 45% more than your after-tax income. To calculate how much you can afford with this model, determine your gross income before taxes and multiply it by 35%.

What’s the best LTV to have?

As a general rule of thumb, your ideal loan to value ratio should be somewhere under 80%. Anything above 80% is considered a high LTV – there are plenty of mortgages available for people with LTVs at 80, 90 or even 95%, but you’ll be paying much more on interest.

Is a low LTV good?

The lower your LTV, in general, the better off you’ll be when it comes to borrowing money. Having a lower LTV can increase your odds of securing a better home mortgage and means you’ll have more equity in your home.