In order to become a seller on Amazon, visit the Amazon Seller Sign up page and click on the ‘Register Now’ button to begin the process of seller registration. During this seller registration process, you need to provide basic details like the name of your business entity, official address, and the phone number.

Accordingly, Is seller account on Amazon free?

An individual account is free to create, but you need to pay a commission of $0.99 for every sale that you make on Amazon. There are also additional referral fees and variable closing fees that are part of every Amazon sale.

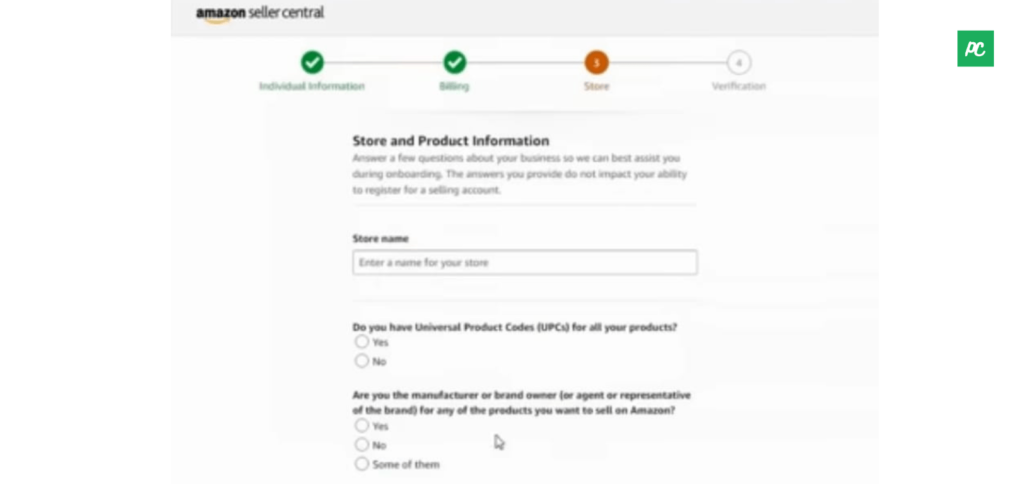

as well, How do I set up a seller account? How to create a seller account on Amazon

- Go to https://services.amazon.com.

- Click on “Learn more” …

- Choose between an individual or professional seller account. …

- Enter your email and select ‘Create a New Account’ …

- Choose your ‘Business location’ and ‘Business type’ …

- Enter your personal information.

Can I open Amazon seller account without company? Registering as a seller on Amazon does not require you to establish a company, especially if you are only selling a limited number of products and will only be selling seasonally.

So, Is Amazon GST number mandatory to sell? Yes. If you are listing taxable goods, GST details are required to sell online. You need to provide GST number to Amazon at the time of registration. However, if you are selling only GST exempted categories, then this may not be required.

What is required for Amazon seller account?

Account Setup

You will need to provide a valid credit card, bank account, phone number, and tax information. With a North America Unified Account, you can conveniently switch in Seller Central between Amazon.com, Amazon.ca, and Amazon.mx seller tools to list products and manage orders in both marketplaces.

Is GST registration free?

No charges are levied to complete the GST registration process. In case businesses do not complete the registration process, 10% of the amount that is due or Rs. 10,000 will be levied. In the case of tax evasion, 100% of the amount that is due will be levied as a penalty.

Can I sell on Amazon from home?

One such great opportunity of starting a business from home is to start an online business on Amazon. To register as a seller on Amazon all you need is a smartphone or a desktop with an active internet connection. New seller registration on Amazon is a simple process and does not involve any cost.

Do I pay GST if not registered?

If you don’t register for GST and are required to, you may have to pay GST on sales made since the date you were required to register. This could happen even if you didn’t include GST in the price of those sales. You may also have to pay penalties and interest.

Do I need to file taxes if I sell on Amazon?

The short answer is yes. You need to report your Amazon sales as income on your taxes, just like your other income streams. That’s why tax season is not when you need to get everything together for your Amazon FBA business.

Can I sell online without GST number?

You can sell online without GST only if you sell goods which are exempted. If you sell goods on which GST is applicable, then you has to get GST number to be able to sell online. You has to take GSTIN even if turnover is less than Rs. 20 lakh.

Who is eligible for GST?

Who should register for GST? All the businesses supplying goods whose turnover exceeds INR 40 lakh in a financial year are required to register as a normal taxable person. However, the threshold limit is INR 10 lakh if you have a business in the north-eastern states, J&K, Himachal Pradesh, and Uttarakhand.

How do I calculate GST?

The formula for GST calculation:

- Add GST: GST Amount = (Original Cost x GST%)/100. Net Price = Original Cost + GST Amount.

- Remove GST: GST Amount = Original Cost – [Original Cost x {100/(100+GST%)}] Net Price = Original Cost – GST Amount.

Can I get GST number without shop?

Even sole proprietors and partnership businesses can apply for and obtain a GSTIN. small taxpayers need to file only eight returns, including four GSTR-3B and GSTR-1 returns, saving them from having to file 16 returns. The following individuals and organisations should mandatorily have a GSTIN in India.

What is FBA Amazon?

Fulfillment by Amazon (FBA) is a service that helps businesses grow by providing access to Amazon’s logistics network. Businesses send products to Amazon fulfillment centers and when a customer makes a purchase, we handle receiving, packing, shipping, customer service, and returns for those orders.

Can you sell products directly to Amazon?

Yes, you can directly sell to Amazon. As long as your product is performing well on Amazon, selling to Amazon is simply a matter of time.

Does small business need GST?

However, any business whose turnover exceeds Rs 40 lakh in a financial year is required to register under GST. This limit is Rs 20 lakh for service providers. This higher threshold under GST has brought compliance relief to many small businesses, including startups in India.

Do I have to pay GST if I earn under 75000?

If your GST turnover is below the $75,000, registering for GST is optional. You may choose to register if your GST turnover is below the $75,000 threshold, however this means that once registered, regardless of your turnover, you must include GST in your fees and claim GST credits for your business purchases.

Do I have to pay GST if I make less than $30 000?

You have to start charging GST/HST on the supply that made you exceed $30,000. You exceed the $30,000 threshold 1 over the previous four (or fewer) consecutive calendar quarters (but not in a single calendar quarter).

How do I sell a product?

How to Sell a Product Online

- Find your products.

- Identify your niche market.

- Conduct market research.

- Create buyer personas.

- Brand your business.

- Build your e-commerce website.

- Set up processes for payment, shipping, and staying in touch.

- Create high-quality product content.

Do I need a reseller permit to sell Amazon?

For most sellers, the answer is yes, to sell on Amazon, you will need a sales tax permit – at least in your home state.

Do Amazon sellers pay tax?

All sellers making money on Amazon are required to pay Income Tax and Amazon Sales Tax. There are several forms sellers need to consider when filing taxes: 1099-K form (sales tax and shipping fees);

Do you need tax ID to sell Amazon?

Amazon requires that all sellers complete the U.S. Tax Identity Information Interview. You can provide your taxpayer identification information to Amazon by clicking here to use our self-service Tax Interview process that will guide you through entering your taxpayer information and validating your W-9 or W-8BEN form.

Does Amazon pay GST on behalf of seller?

Amazon or any company won’t pay GST to you. They collect and pay GST to government. They are part of the chain and they are SERVICE PROVIDER to us. So, they simply charge GST on various service components, collect the amount and they pay to Govt.

Who pays GST buyer or seller?

Who should pay GST, the buyer of the seller? Goods and Service Tax (GST) is paid by the consumers for the products or services. But the GST will be remitted to the government by the businesses who are providing you with those products and services.

Is GST necessary for small business?

Before the implementation of GST, any business with a turnover of more than Rs 5 lakh in a financial year was required to obtain VAT registration. However, any business whose turnover exceeds Rs 40 lakh in a financial year is required to register under GST.

What is turnover in GST?

Turnover, in common parlance, means the value of a business over a period of time. Aggregate turnover in GST can be described as the taxable value of supplies of goods and services, exempt supplies of goods and services, the export of goods and services and inter-state supplies.

What is the turnover limit for GST?

A business whose aggregate turnover in a financial year exceeds Rs 20 lakhs has to mandatorily register under Goods and Services Tax. This limit is set at Rs 10 lakhs for North Eastern and hilly states flagged as special category states.