Furthermore, How do I add 13 tax to a price?

Add the sales tax to the original price. When you pay a 13% tax on an item, you are paying 100% of the price of the item plus an extra 13%. You can find the total cost of the item by multiplying the before-tax cost by 113%.

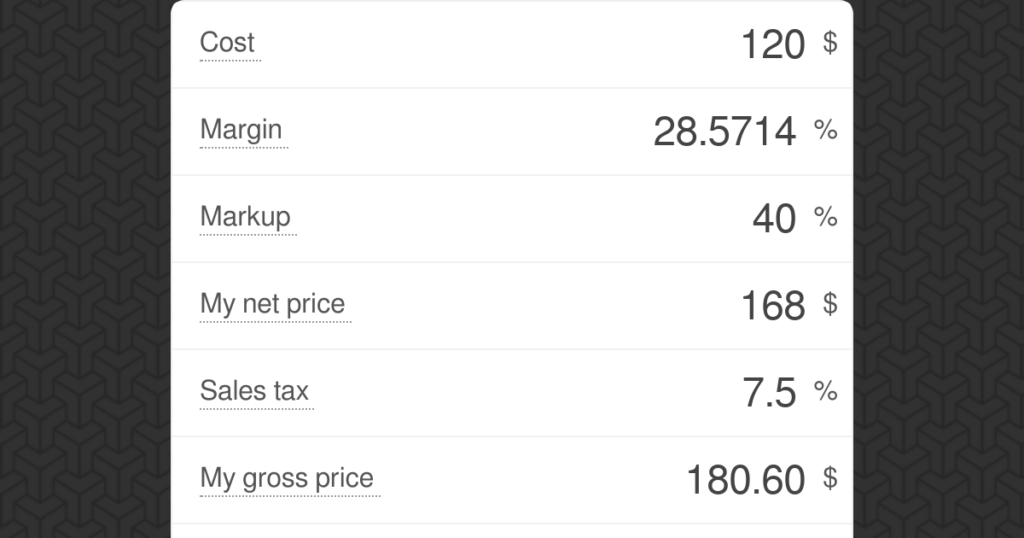

Then, How much is a 6% tax? Calculating sales tax on a product or service is straightforward: Simply multiply the cost of the product or service by the tax rate. For example, if you operate your business in a state with a 6% sales tax and you sell chairs for $100 each, you would multiply $100 by 6%, which equals $6, the total amount of sales tax.

How much do I add to tax? U.S. Sales Tax

| State | General State Sales Tax | Max Tax Rate with Local/City Sale Tax |

|---|---|---|

| California | 7.25% | 10.50% |

| Colorado | 2.90% | 10% |

| Connecticut | 6.35% | 6.35% |

| Delaware | 0% | 0% |

Therefore, How much is the percentage of tax? The federal income tax rates remain unchanged for the 2021 and 2022 tax years: 10%, 12%, 22%, 24%, 32%, 35% and 37%. The income brackets, though, are adjusted slightly for inflation. Read on for more about the federal income tax brackets for Tax Year 2021 (due April 15, 2022) and Tax Year 2022 (due April 15, 2023).

How do you calculate 15 percent tax?

15% is 10% + 5% (or 0.15 = 0.1 + 0.05, dividing each percent by 100). Thinking about it this way is useful for two reasons. First, it’s easy to multiply any number by 0.1; just move the decimal point left one digit. For example, 75.00 x 0.1 = 7.50, or 346.43 x 0.1 = 34.64 (close enough).

What percentage is tax calculator?

U.S. Sales Tax

| State | General State Sales Tax | Max Tax Rate with Local/City Sale Tax |

|---|---|---|

| Arizona | 5.60% | 10.73% |

| Arkansas | 6.50% | 11.63% |

| California | 7.25% | 10.50% |

| Colorado | 2.90% | 10% |

How do I figure tax percentage from total?

To calculate the sales tax that is included in a company’s receipts, divide the total amount received (for the items that are subject to sales tax) by “1 + the sales tax rate”. In other words, if the sales tax rate is 6%, divide the sales taxable receipts by 1.06.

How do you add 8 sales tax?

If, for example, your city’s tax rate is 8%, you would convert it to 0.08. Next. multiply the decimal by the price of the item you want to buy in order to calculate your sales tax. For example, if your item is $20, multiply 20 by 0.08 to get $1.60, which is the sales tax.

Is sales tax added or multiplied to the price?

Sales taxes are added to the cost of purchases. Sales taxes are imposed by state and local governments as a means to raise revenues. Sales taxes are a type of consumption tax because the tax applies only to purchases.

What is the tax on $7000?

If you make $7,000 a year living in the region of California, USA, you will be taxed $620. That means that your net pay will be $6,381 per year, or $532 per month. Your average tax rate is 8.9% and your marginal tax rate is 8.9%.

How much tax do I pay on $25000?

If you make $25,000 a year living in the region of California, USA, you will be taxed $3,858. That means that your net pay will be $21,142 per year, or $1,762 per month. Your average tax rate is 15.4% and your marginal tax rate is 24.9%.

How much tax do you pay on $10000?

The 10% rate applies to income from $1 to $10,000; the 20% rate applies to income from $10,001 to $20,000; and the 30% rate applies to all income above $20,000. Under this system, someone earning $10,000 is taxed at 10%, paying a total of $1,000. Someone earning $5,000 pays $500, and so on.

How do I calculate sales tax backwards calculator?

How to Calculate Sales Tax Backwards From Total

- Subtract the Tax Paid From the Total.

- Divide the Tax Paid by the Pre-Tax Price.

- Convert the Tax Rate to a Percentage.

- Add 100 Percent to the Tax Rate.

- Convert the Total Percentage to Decimal Form.

- Divide the Post-Tax Price by the Decimal.

How much is $500 after taxes?

Calculate Take-Home Pay

If the gross pay is $500, Social Security and Medicare combined come to $38.25. The employee’s federal income tax is $47.50. After these amounts are subtracted, the take-home pay comes to $414.25.

How much tax do you pay on $1000000?

Taxes on one million dollars of earned income will fall within the highest income bracket mandated by the federal government. For the 2020 tax year, this is a 37% tax rate.

How much taxes would I pay on $500000?

If you make $500,000 a year living in the region of California, USA, you will be taxed $216,666. That means that your net pay will be $283,334 per year, or $23,611 per month. Your average tax rate is 43.3% and your marginal tax rate is 51.1%.

How much taxes will I pay on $50000?

If you are single and a wage earner with an annual salary of $50,000, your federal income tax liability will be approximately $5700. Social security and medicare tax will be approximately $3,800. Depending on your state, additional taxes my apply.

How much taxes do you pay on $35000?

If you make $35,000 a year living in the region of California, USA, you will be taxed $6,366. That means that your net pay will be $28,634 per year, or $2,386 per month. Your average tax rate is 18.2% and your marginal tax rate is 26.1%.

What do I owe in taxes if I made $120000?

If you make $120,000 a year living in the region of California, USA, you will be taxed $39,076. That means that your net pay will be $80,924 per year, or $6,744 per month. Your average tax rate is 32.6% and your marginal tax rate is 42.9%.

How much tax do I pay on $500000?

If you make $500,000 a year living in the region of California, USA, you will be taxed $216,666. That means that your net pay will be $283,334 per year, or $23,611 per month. Your average tax rate is 43.3% and your marginal tax rate is 51.1%.

How much taxes do you pay if you make $120000?

If you make $120,000 a year living in the region of California, USA, you will be taxed $39,076. That means that your net pay will be $80,924 per year, or $6,744 per month. Your average tax rate is 32.6% and your marginal tax rate is 42.9%.

How do I subtract tax from a total?

What is a Sales Tax Decalculator?

- Step 1: take the total price and divide it by one plus the tax rate.

- Step 2: multiply the result from step one by the tax rate to get the dollars of tax.

- Step 3: subtract the dollars of tax from step 2 from the total price.

- Pre-Tax Price = TP – [(TP / (1 + r) x r]

- TP = Total Price.

How do you find the original price?

This calculation helps you to find the original price after a percentage decrease.

- Subtract the discount from 100 to get the percentage of the original price.

- Multiply the final price by 100.

- Divide by the percentage in Step One.