Hence, How do you calculate profit in Cryptocurrency trading?

You calculate crypto profit by subtracting the selling price from the cost price of the cryptocurrency. That is one of the simplest ways to calculate your profit and loss.

Consequently, How is crypto profit and loss calculated? Subtract the Selling Price from the Cost Price

Subtracting the selling price from the cost price is the simplest way to calculate profits and losses. All you have to do is remove/subtract the amount you sold the crypto from the amount you bought it for.

How much profit do you get from crypto? To take out and maximize your gains, sell 5-10% at a time, depending on how big your holdings are in that particular crypto. If the crypto has gained more than 30% since you bought it, consider selling a small percentage every week.

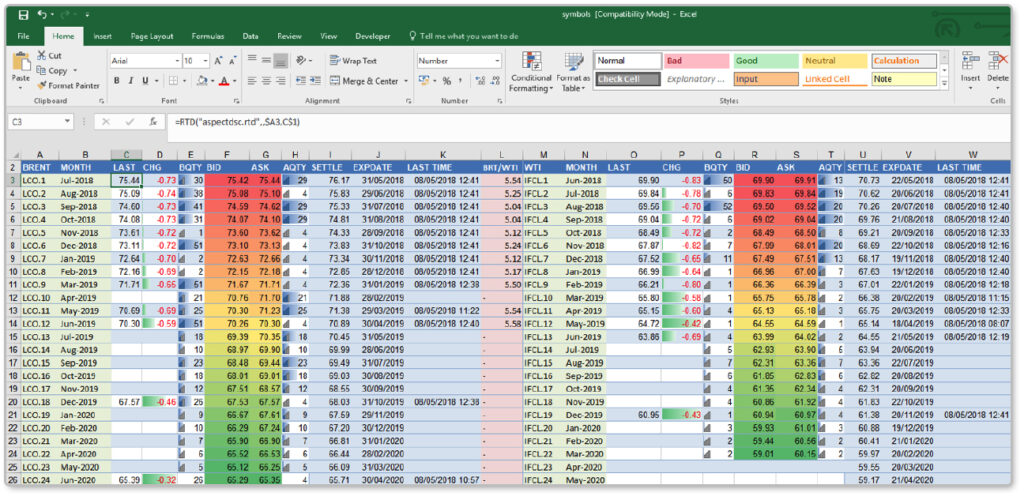

In addition, How does excel track crypto prices? To get our cryptocurrency prices we can use the function “=cs. price(Ticker, USD)“, this function basically grabs the price of a particular cryptocurrency through two inputs; the cryptocurrency ticker symbol and the quote (USD).

How do I keep track of crypto taxes?

Reporting crypto capital gains and losses

Your capital gains and losses from your crypto trades get reported on IRS Form 8949. Form 8949 is the tax form that is used to report the sales and disposals of capital assets, including cryptocurrency. Other capital assets include things like stocks and bonds.

Can you pull live crypto prices into Excel?

The data will be downloaded via an API from coinmarketcap.com. Once you’ve set up the API, it becomes a breeze to pull crypto prices and data into Excel, in just a matter of seconds.

How do I track my crypto portfolio?

Cryptocurrency portfolio tracker allows you to track the total amount and value of your cryptocurrencies across all wallets, exchanges, platforms, and blockchains in real-time.

List of Top Crypto Portfolio Tracker Apps

- Pionex.

- CoinSmart.

- Crypto.com.

- Coinmama.

- Coin Market Manager.

- Blockfolio.

- Delta.

- CoinStats.

How do I get crypto price in Google Sheets?

Do I have to report crypto on taxes if I didn’t sell?

“If you just bought it and didn’t sell anything, you can actually answer ‘no’ to that question because you do not have any taxable gains or losses to report,” he says.

Do you pay taxes on crypto if you don’t sell?

Buying crypto on its own isn’t a taxable event. You can buy and hold cryptocurrency without any taxes, even if the value increases. There needs to be a taxable event first such as selling the cryptocurrency. The IRS has been taking steps to ensure that crypto investors pay their taxes.

Do I have to report crypto on taxes if I lost money?

People might refer to cryptocurrency as a virtual currency, but it’s not a true currency in the eyes of the IRS. According to IRS Notice 2014-21, the IRS considers cryptocurrency to be property, and capital gains and losses need to be reported on Schedule D and Form 8949 if necessary.

Can an Excel file be an NFT?

A Collection of ridiculous Excel NFTs, made in Excel, about Excel. Excel is life.

Is Cryptosheets free?

Can I get started for free? Yes! All accounts receive 1000 free queries per month that reload automatically.

How do I get data from Binance in Excel?

Part 1: Run an API Request

- Select Binance from the drop-down list of applications.

- Select an endpoint. These endpoints are all open so you don’t need an API key.

- Choose a destination sheet, name your request, and hit Run. A moment later you’ll see price change stats for all currency pairs in your sheet.

What is the best crypto portfolio?

10 Best Crypto Portfolio Tracker Apps in 2022

- CoinTracker.

- CoinStats.

- The Crypto App.

- Delta.

- CoinGecko.

- CoinMarketCap.

- Altrady.

- Kubera.

Which cryptocurrency should I invest in 2021?

Top 10 Cryptocurrencies In India

- Bitcoin (BTC) Market cap: Over $846 billion.

- Ethereum (ETH) Market cap: Over $361 billion.

- Tether (USDT) Market cap: Over $79 billion.

- Binance Coin (BNB) Market cap: Over $68 billion.

- XRP (XRP) Market cap: Over $37 billion.

- Terra (LUNA) Market cap: Over $34 billion.

- Cardano (ADA)

- Solana (SOL)

How do I monitor crypto prices?

Cryptocurrency price trackers should use reliable data and consistently update their data. CoinMarketCap is the industry’s most popular and recognizable cryptocurrency price tracker; other trackers include Coinlib and Bitgur.

Can Google Sheets track crypto?

With this Google Sheet, you can track your cryptocurrency purchases. And also, you can view a summary of your total assets with the Dollar Cost Average (DCA) for each cryptocurrency. In addition to that, you can get the present value of cryptocurrencies with a single click.

Can Google Sheets track crypto prices?

Step 1. Go to the CoinMarketCap website and click on the crypto you want to pull price information from. For example if you want to pull the price information for Bitcoin, then you need to go to the following page CoinMarketCap.com/currencies/bitcoin. Copy the url and past it into your google sheets document as such.

Does GOOGLEFINANCE work with crypto?

Google Finance, a data site maintained by the tech giant, now has a dedicated “crypto” field. And it has prominent placement, too. Right at the top of the page, where users can “compare markets,” crypto is listed among the five default markets, which also includes U.S., Europe, Asia and “Currencies.”

Do you have to report crypto under $600?

If you earn $600 or more in a year paid by an exchange, including Coinbase, the exchange is required to report these payments to the IRS as “other income” via IRS Form 1099-MISC (you’ll also receive a copy for your tax return).

Will Coinbase send me a 1099?

Coinbase will issue an IRS form called 1099-MISC to report miscellaneous income rewards to customers that meet the following criteria: You’re a Coinbase customer AND. You’re a US person for tax purposes AND.

What amount of crypto is taxable?

If your losses exceed your gains, you can deduct up to $3,000 from your taxable income (for individual filers). The amount of time you owned the crypto plays a part, too. If you held onto a unit of Bitcoin for more than a year, it would generally qualify as a long-term capital gain.

Do I need to report crypto under $600?

If you earn $600 or more in a year paid by an exchange, including Coinbase, the exchange is required to report these payments to the IRS as “other income” via IRS Form 1099-MISC (you’ll also receive a copy for your tax return).

Is crypto taxable in 2021?

If you sold crypto and made money on it in 2021, you need to pay taxes on the gains. That’s why you should keep good records of all your crypto transactions. The U.S. government recently passed a bill that requires crypto exchanges to issue a Form 1099 for all their customers, starting with the 2023 tax year.

Can I write off my crypto losses?

Can you write off crypto losses on your taxes? Yes. If you sell your cryptocurrency at a loss, you can offset your capital gains and $3000 of personal income for the year.

What is NFT in Crypto?

NFT stands for non-fungible token. It’s generally built using the same kind of programming as cryptocurrency, like Bitcoin or Ethereum, but that’s where the similarity ends. Physical money and cryptocurrencies are “fungible,” meaning they can be traded or exchanged for one another.

How do I check my NFT value?

To track and verify your own NFT transactions, whether you bought or sold an NFT, you can go to Etherscan.io, to search by address, transaction hash, block, token and ens, while sites like CryptoSlam.io allow for NFT sales history, collection rankings, market data and specific projects.

How do I view NFT?

How do I see an NFT in my Metamask wallet?

- Step 1 : Find the NFT’s address.

- Step 2: In MetaMask Mobile, tap on the ‘NFTs’ tab, scroll down, and tap on the “+ ADD NFTs” link.

- Step 3: Find the NFT’s ID.

- Step 4: Copy it onto your clipboard.