How To Calculate DCA. The Formula: dividing the sum of total cost by the number of the total shares. Example: Last week Tony bought a cryptocurrency coin called ADA (Cardano), he bought 100 ADA with an average buy of 2$ so the total cost is 200$. After a month, the cryptocurrency that he bought dropped to 1$.

Hence, Does DCA work for Bitcoin?

Although DCA is a popular way to buy Bitcoin, it isn’t unique to crypto — traditional investors have been using this strategy for decades to weather stock market volatility. You may even use DCA already if you invest via your employer’s retirement plan every payday.

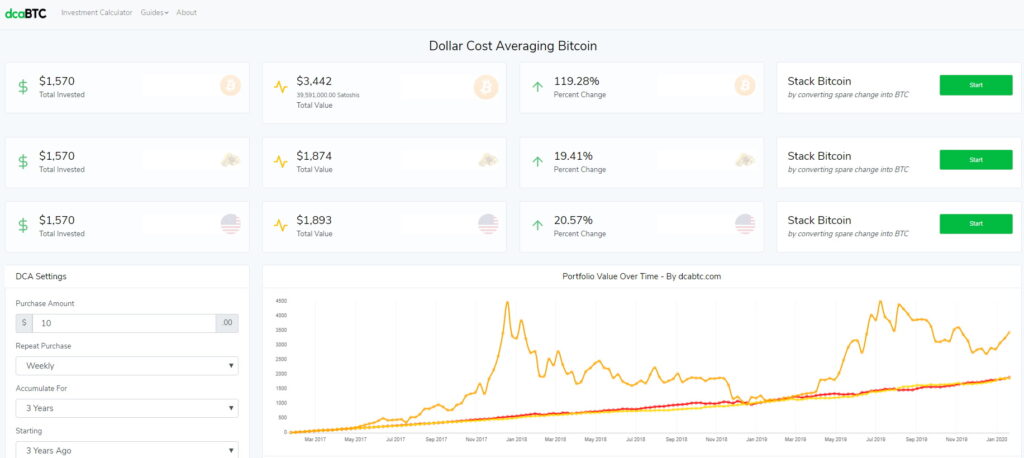

Consequently, How do I convert DCA to Bitcoin? How do you use dollar-cost averaging in crypto? To implement the dollar-cost averaging method, simply choose a set amount of money you want to invest into your choice of crypto, over a set period of time. Then, regardless of where the market sits, you keep investing your money until you reach your set time.

Is DCA crypto a good idea? However, there’s broad consensus that DCA is a safer overall method of investing than lump sum buying and selling. It’s lower risk and lower reward, but still offers the chance of benefiting from market swings.

In addition, How often do you do DCA? Logically, then, DCA should not be used over periods of 2 or 3 years, not even 18 months. A DCA period between 6 and 12 months is probably best.

What is DCA in crypto trading?

Investors often wonder about the best approach to cryptocurrency investments, hence the reason for this article. Dollar-cost averaging (DCA) is an investing strategy where an investor invests a total sum of money in small increments over a period of time as opposed to investing all at once.

Is it best to DCA daily or weekly?

It depends on the amount of time you want to dedicate to your investments, as well as if you are getting your salary weekly or monthly. Both approaches work, however, a weekly DCA frequency will most likely cost you more on broker fees.

Is it better to invest lump sum or monthly?

You’re more likely to end up with higher returns.

Lump-sum investing outperforms dollar cost averaging almost 75% of the time, according to data from Northwestern Mutual, regardless of asset allocation. If you’re comfortable with risk, then investing your money in one large sum could yield better results.

Is it better to invest weekly or biweekly?

If you get paid every 2 weeks and want to invest some of it, you will (on average) get a better return investing it as soon as you get it, vs waiting. (So if you have $100 to invest, you’ll make more on average by putting it all in at once than by investing it over 7 days.

How much should I DCA into crypto?

In general, experts recommend keeping your cryptocurrency investments to under 5% of your portfolio, and prioritizing more pressing aspects of your financial life, such as saving for an emergency, contributing to a retirement account, and paying off high-interest debt.

How do you use crypto DCA?

Dollar cost averaging (DCA) is the process of investing your money over time. Instead of investing in one single lump sum and trying to time the market to your advantage, you divide your initial investment into several tranches and trade at a set time periodically.

How do you properly use DCA?

How do you get rich on Coinbase?

How do you stock DCA?

The calculation for dollar-cost averaging works the same as calculating the average or mean for a set of numbers. In the case of DCA, the investor adds investment purchase prices, then divides the sum by the amount of purchases made.

What is the best cryptocurrency to invest in 2021?

7 best cryptocurrencies to buy now:

- Bitcoin (BTC)

- Ether (ETH)

- Solana (SOL)

- Binance Coin (BNB)

- FTX Token (FTT)

- Celo (CELO)

- STEPN (GMT)

Where should I invest 100k in 2021?

How To Invest 100k: The 5 Best Ways

- Investing in real estate.

- Individual stocks investing.

- ETFs and mutual funds.

- Investing in IRAs.

- Peer-to-peer lending.

What is the best day to invest?

If you’re interested in short selling, then Friday may be the best day to take a short position (if stocks are priced higher on Friday), and Monday would be the best day to cover your short. In the United States, Fridays on the eve of three-day weekends tend to be especially good.

What day of the month is best to invest?

Studying a period from Jan. 1, 1990, to Dec. 31, 2005, the authors concluded that “the best day of the month to invest in NASDAQ, Dow Jones Industrial Average, and S&P 500 is the 23rd day of each month.

What day is the best day to invest?

And according to it, the best days for trading are Mondays. This is also known as “The Monday Effect” or “The Weekend Effect”. The Monday Effect – a theory suggesting that the returns of stocks and market movements on Monday are similar to those from the previous Friday.

How much will I have if I invest 100 a month?

Investing $100 per month will grow to more than $160,000 when you are ready to retire in 47 years. At $500 a month, the same 20-year-old would retire with more than $800,000 if they stuck to their saving. If you bump that number up to $1,000 per month, your total will grow to over $1.6 million for retirement.

What day of the month is best to invest?

Stock prices tend to fall in the middle of the month. So a trader might benefit from timing stock buys near a month’s midpoint—the 10th to the 15th, for example. The best day to sell stocks would probably be within the five days around the turn of the month.

How much would I have if I invested $1000 in Bitcoin in 2010?

$1,000 Invested in Bitcoin in 2010 is Worth $287.5 Million Today (as of the time of this writing)

What will Bitcoin be worth in 2030?

In 2020 the global cryptocurrency market amounted to $1.49bn. According to Allied Market Research, by 2030 its value could grow to $4.94bn by 2030 – representing a 12.8% surge.

What will Bitcoins be worth in 2025?

What will Bitcoins worth be in 2025? According to our Bitcoin price forecast, BTC will be worth around $92K-$98K in the year 2025.

Can you DCA on Binance?

Recurring Buy allows users to automate the buying of crypto. It is a dollar-cost averaging (DCA) investment strategy which allows users to choose the cryptocurrency they want to purchase, the amount they want to buy, and how often they would like to buy.

How often should I dollar cost average?

Dollar-cost averaging is the practice of putting a fixed amount of money into an investment on a regular basis, typically monthly or even bi-weekly. If you have a 401(k) retirement account, you’re already practicing dollar-cost averaging, by adding to your investments with each paycheck.

How can I make $100 a day?

QUICK TIP TO MAKE $100 A DAY ONLINE: You can make extra money by starting your own blog!

- Take part in research (up to $150/hour)

- Get paid to take surveys.

- Become a shopper.

- Get paid to watch videos online.

- Wrap your car.

- Sell your crafts.

- Download these 2 apps and make $125 by going online.

- Make an extra $100 pet sitting.

How do you make 100 dollars a day cryptocurrency?

Can I make passive income on Coinbase?

To buy Passive Income, you’ll need to first purchase Ethereum (ETH) and then use ETH to buy Passive Income. And to do that, you need what’s called a self-custody wallet. Here’s how to do that using Coinbase Wallet for U.S. residents.