Press ‘clock in’ when arriving at work, ‘start lunch’ when taking a lunch break, etc. Time is recorded into the system. You must record the time you work every day by clocking in and out for the work day and for lunch in Paylocity on a desktop, laptop or mobile phone.

Accordingly, How do I use Paylocity app?

as well, How do I process payroll in Paylocity? Getting Started with Running Your First Payroll

- Add and start a payroll batch.

- Edit the Quick Pay screen.

- Edit the Pay Details screen.

- Create an Additional and a Manual Check.

- Verify Batch Totals.

- Complete the audit screen, approve the batch, and submit.

How do you punch in and out on Paylocity?

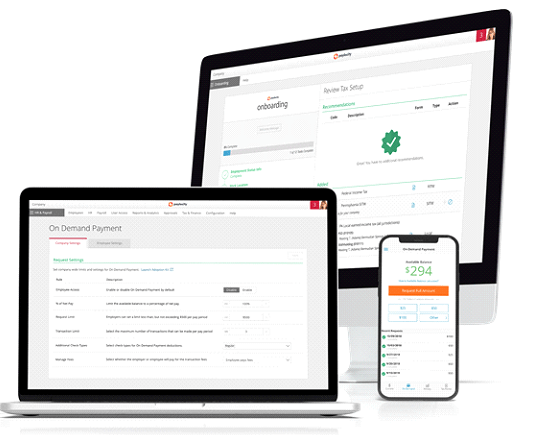

So, Does Paylocity have an app? To turn your mobile device into a Payroll and HR information powerhouse, download the free app from Google Play for Android or the Apple ITunes App Store for iOS devices. Paylocity Mobile provides convenient Self Service access to your individual Payroll and Human Resource information, 24/7.

What is Paylocity app?

With the Paylocity mobile HR app, we bring our solutions directly to you, wherever you are. From viewing paychecks to requesting time off, to staying in touch with coworkers, our HR app gives you the freedom to stay connected anywhere, anytime.

How do I log hours on Paylocity app?

After logging in to Paylocity, select TIME & LABOR from the drop down or LAUNCH TIME & ATTENDANCE from the timeclock in the upper right corner, it will display TIME & LABOR and a timeclock where you can also clock in or out. The functions here are the same as via the clock in Self-service (see below).

How do you process payroll?

How to process payroll

- Step 1: Establish your employer identification number.

- Step 2: Collect relevant employee tax information.

- Step 3: Choose a payroll schedule.

- Step 4: Calculate gross pay.

- Step 5: Determine each employee’s deductions.

- Step 6: Calculate net pay, and pay your employees.

How long does it take for payroll to process?

Businesses that utilize payroll processing solutions typically complete their internal processes in 1-2 days. Once payroll is submitted, it takes 2-3 days for wages to be deposited into employee bank accounts. On average, employees receive their paychecks within five days of the pay period end date.

How is payroll done?

It involves calculating total wage earnings, withholding deductions, filing payroll taxes and delivering payment. These steps can be accomplished manually, but an automated process is usually more accurate and efficient and may help you comply with various payroll regulations.

Why is Paylocity not working?

There may be several reasons for that: An outage that hasn’t been communicated yet via the Paylocity status page. Some local issues with a small group of accounts on the service side. Technical issues on your side, or problems with your software or ISP.

Is Paylocity a good payroll company?

2) I have worked with a few payroll companies during my HR tenure and Paylocity by far is the best product on the market. It is so user friendly. Employees love it because it is easy to use, it has a mobile app, and anything they need related to payroll and benefits is in one place.

How do I terminate an employee on Paylocity?

- OF 11. The first step is to search for the employee and click the three dots under Actions. Click.

- OF 11. Click Edit. Click.

- OF 11. Click Work. Click.

- OF 11. Click Change Employee Status. Click.

- OF 11. Select HR Action. Click.

- OF 11. Select Employee Status. Click.

- OF 11. Enter Termination Date.

- OF 11. Select Change Reason.

How do I get my W2 from paylocity?

How to View W2 Form – Paylocity

- Open the Paylocity Mobile App.

- Log in.

- Select Pay from the main menu.

- Select Tax Forms.

- Select the applicable W2.

How do I check my paylocity schedule?

- From the Self-Service Portal. Select Web Pay and Web Time from the top menu bar.

- Select My Timesheet from the top menu. Date Range – you can view your timesheet by pay.

- period or you can select a date range by selecting the.

- DATE – review the date you are entering time for.

- allocated on your timesheet.

- • Work.

How do I check my schedule on paylocity app?

After logging in to Paylocity, select TIME & LABOR from the drop down or LAUNCH TIME & ATTENDANCE from the timeclock in the upper right corner, it will display TIME & LABOR and a timeclock where you can also clock in or out. The functions here are the same as via the clock in Self-service (see below).

Can I get my W2 from Paylocity?

Please see the step-by-step instructions below on accessing your W2 information on Paylocity. Note: We show you how to access your W2 using the mobile app or a computer browser.

How long does payroll take to process Paylocity?

Once payroll is submitted, it takes 2-3 days for wages to be deposited into employee bank accounts. On average, employees receive their paychecks within five days of the pay period end date.

How do I submit time off on Paylocity?

Go to your Paylocity account and log in. Click on “More” under “Time Off”. Then click on “Submit Time Off Request”. Then fill out all the fields: “Start Date,” “End Date,” “Start Time,” “End Time.” The “Notes” section is optional.

How do I set up benefits in Paylocity?

Enroll on the Go!

Select and review plans from your mobile device in the office, at home, or on the go. Add or change members or dependents from the convenience of your mobile phone. Review and submit elections to keep your benefits selections on track.

Can I run payroll myself?

Step 1: Choose a full-service payroll provider.

If you’re not sure how to do payroll yourself, use payroll software that reduces the risk of errors or fines. Many payroll processing services, like Square Payroll, handle your payroll taxes, filings, new hire reporting for you, and allow you to complete payroll online.

Who prepares the payroll?

Thus, to answer the question at hand, it is ideal that the Human Resource Office prepares the payroll since they hold records of attendance and overtime services rendered by the employees, the Accounting unit prepares payment, subject to the approval of the Head of Agency or his duly authorized representative.

How do payroll employees run hourly?

For hourly employees, you need the pay rate per hour and the number of regular and overtime hours worked. To find an hourly employee’s gross wages, multiply the number of hours worked by their hourly pay rate. Say your biweekly employee makes $10 per hour. They work 32 hours during the pay period.

Can you get paid early with paylocity?

Make Any Day Payday With Instant Pay

Giving them early wage access can help. Now you can offer your workforce the option to access a portion of earned wages before their scheduled payday, quickly, and without disrupting your payroll process with extra paperwork.

Is paylocity a good payroll company?

2) I have worked with a few payroll companies during my HR tenure and Paylocity by far is the best product on the market. It is so user friendly. Employees love it because it is easy to use, it has a mobile app, and anything they need related to payroll and benefits is in one place.

How long after my timesheet is approved do I get paid?

After you have sent in your timesheet for processing, you should receive your paycheck within 10 working days of receipt by the Timesheet Processing Facility.