Example of Futures Contracts

An oil producer needs to sell its oil. They may use futures contracts to do it. This way they can lock in a price they will sell at, and then deliver the oil to the buyer when the futures contract expires. Similarly, a manufacturing company may need oil for making widgets.

Accordingly, How do you calculate futures profit in Binance?

as well, How do you trade futures for beginners? Open an account with a broker that supports the markets you want to trade. A futures broker will likely ask about your experience with investing, income and net worth. These questions are designed to determine the amount of risk the broker will allow you to take on, in terms of margin and positions.

Are futures high risk? Futures, in and of themselves, are not any riskier than other types of investments, such as owning equities, bonds, or currencies. That is because futures prices depend on the prices of those underlying assets, whether it is futures on stocks, bonds, or currencies.

So, How do futures contracts work? Futures are a type of derivative contract agreement to buy or sell a specific commodity asset or security at a set future date for a set price. Futures contracts, or simply “futures,” are traded on futures exchanges like the CME Group and require a brokerage account that’s approved to trade futures.

How do you calculate future profit in crypto?

How do you calculate crypto profit? You calculate crypto profit by subtracting the selling price from the cost price of the cryptocurrency. That is one of the simplest ways to calculate your profit and loss.

How do you calculate ROE in future Binance?

ROE is calculated by dividing a company’s net income by its shareholder equity, and then multiplying the figure by 100 to get a percentage.

How do you successfully trade futures?

7 Tips Every Futures Trader Should Know

- Establish a trade plan. The first tip simply can’t be emphasized enough: Plan your trades carefully before you establish a position.

- Protect your positions.

- Narrow your focus, but not too much.

- Pace your trading.

- Think long—and short.

- Learn from margin calls.

- Be patient.

How much money do you need to start trading futures?

Each broker sets its own minimum deposit amounts to open an account. The lowest opening balance for a futures broker account is around $2,500. Most commodity futures brokers require new account holders to deposit a minimum of $5,000 to $10,000.

What is Future Trading example?

Futures trading is common with commodities. For example, if someone buys a July crude oil futures contract (CL), they are saying they will buy 1,000 barrels of oil from the agreed price upon the July expiration, no matter what the market price is at that time.

Are futures profitable?

Trading futures is as profitable as the trading strategy used. For the most part, a trader’s success is determined by his trading strategy and how well he executes the strategy. With a good strategy and proper execution, you can become a profitable futures trader.

Is trading futures gambling?

There’s one key element that sets futures trading apart from gambling: you. The individual determines the rules of the game ― not the casino. Futures furnish you with the ability to assume risk, identify reward, and develop strategies on your own terms.

How long can you hold futures?

The maximum duration for a futures contract is three months. In a typical futures and options transaction, the traders will usually pay only the difference between the agreed upon contract price and the market price. Hence, you don’t have to pay the actual price of the underlying asset.

Can I sell futures before expiry?

Before Expiry

It is not necessary to hold on to a futures contract till its expiry date. In practice, most traders exit their contracts before their expiry dates. Any gains or losses you’ve made are settled by adjusting them against the margins you have deposited till the date you decide to exit your contract.

What happens if you hold a futures contract until expiration?

When the contract expires, the position is automatically closed. If the settlement price of the asset is higher than when your entry price, you have made a profit, but if it’s lower, you have made a loss. Whatever profit or loss realized is added to or subtracted from your account.

What are futures vs stocks?

Futures are contracts with expiration dates, while stocks represent ownership in a company.

Can Bitcoin hit a million?

The crypto could reach a price of $1.3 million calculated using M0 and may top $4.8 million using M2, according to the analysts. Bitcoin is trading at around $46,363, up 1% over the past 24 hours, according to CoinDesk data.

How do you calculate crypto gains and losses?

To calculate the gain or loss, the difference between the adjusted cost base (ACB) of the virtual currency and the amount received, in the case of legal tender, or the FMV of the virtual currency or the service received in exchange must be determined in U.S. dollars for the time of the exchange.

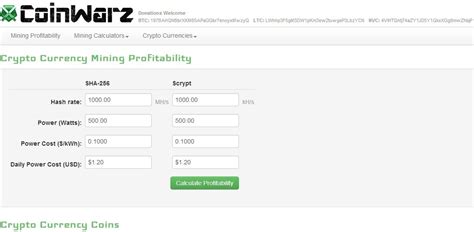

How is Bitcoin mining profit calculated?

For an estimate, using a 2.50% commission, net mining revenue is 0.00068445 BTC. 0.000702 BTC is calculated by 68 (miner hashrate) ÷ 85,000,000 (network hashrate) × 144 (number of blocks per day) × 6.25 (block reward). If BTC is priced at $50,000 USD, then this M20S has a daily revenue of about $34 USD.

Is ROI and ROE same?

ROI is a performance measure used to assess the profitability of a business or an investment by taking into account the profits or losses relative to the cost of the investment. Return on equity (ROE), on the other hand, is a financial metric that asses the profitability of a business in relation to the equity.

What does ROE mean in futures trading?

Return on Equity (ROE) is an indicator which reflects the performance of a trade. Positive ROE means that the trade is profitable while negative ROE means that the trade generates losses.

How are Binance future risks calculated?

The risk/reward ratio (R/R ratio or R) calculates how much risk a trader is taking for potentially how much reward. In other words, it shows what are the potential rewards for each $1 you risk on an investment. The calculation itself is very simple. You divide your maximum risk by your net target profit.

Is it profitable to trade futures?

An investor with good judgment can make quick money in futures because essentially they are trading with 10 times as much exposure than with normal stocks. Also, prices in the future markets tend to move faster than in the cash or spot markets.

How many futures traders are successful?

90% of all day traders lose money!

Tradeciety provides clearer and more time-specific futures trading stats–namely, that 40% of all futures day traders quit in 4 months, 80% quit within a year, and that only 7% are able to last 5 years or more.

How much do day traders make per year?

Day Traders in America make an average salary of $118,912 per year or $57 per hour. The top 10 percent makes over $195,000 per year, while the bottom 10 percent under $72,000 per year. How much should you be earning as an Day Trader? Use Zippia’s Salary Calculator to get an estimation of how much you should be earning.