Furthermore, How do you track profit/loss in crypto?

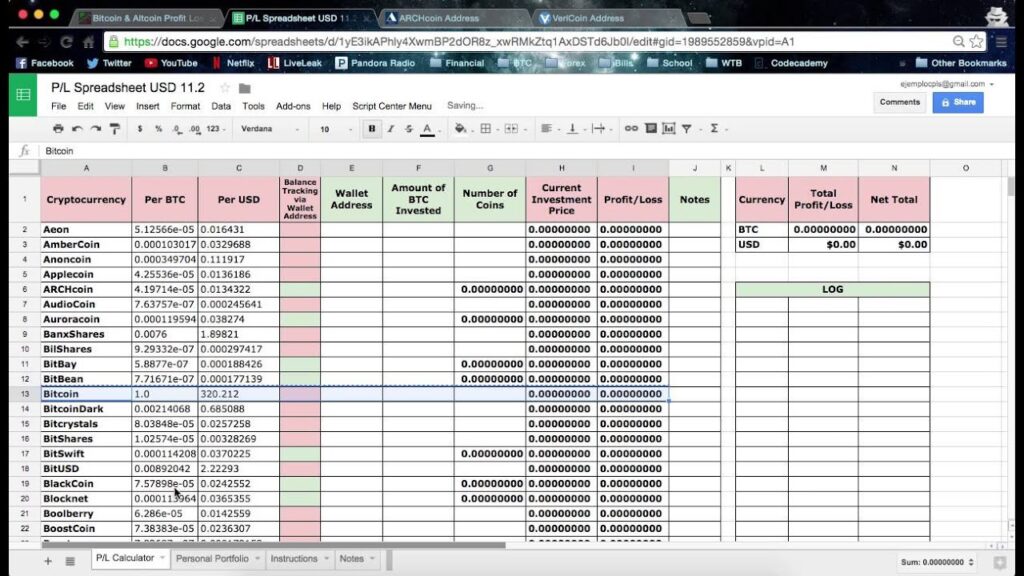

Then, How do I track crypto portfolio in Google Sheets?

- What do you need to create this Google Sheets Crypto Tracker. …

- Copy the Google Sheet to your Drive. …

- Create a Free CoinMarketCap account, get the API key, and Add it to Google Sheet. …

- Getting crypto price updates to Google Sheets with Google Apps Script. …

- Add a new cryptocurrency to your portfolio. …

- Add crypto purchase records.

How do I track my crypto earnings? The best crypto portfolio tracker is CoinStats and Coin Market Manager. Most intermediate and advanced crypto traders store funds across multiple blockchains and use different wallets for different purposes. This can make tracking your crypto net worth a major pain in the neck.

Therefore, How does Excel track crypto price? To get our cryptocurrency prices we can use the function “=cs. price(Ticker, USD)“, this function basically grabs the price of a particular cryptocurrency through two inputs; the cryptocurrency ticker symbol and the quote (USD).

How do you record crypto transactions?

There are three steps:

- Set up a merchant wallet account. Coinbase has an option to accept cryptocurrencies.

- Integrate the option to accept crypto in your point of sale on your website.

- Link these transactions with your accounting software.

Can you pull live crypto prices into Excel?

The data will be downloaded via an API from coinmarketcap.com. Once you’ve set up the API, it becomes a breeze to pull crypto prices and data into Excel, in just a matter of seconds.

How do I automatically update crypto prices in Excel?

How do I add crypto prices to Google Sheets?

Do I have to report every crypto transaction?

If you earn cryptocurrency by mining it, it’s considered taxable income and might be reported on Form 1099-NEC at the fair market value of the cryptocurrency on the day you received it. You need to report this even if you don’t receive a 1099 form as the IRS considers this taxable income.

Do I have to report crypto on taxes if I didn’t sell?

“If you just bought it and didn’t sell anything, you can actually answer ‘no’ to that question because you do not have any taxable gains or losses to report,” he says.

How do I fill out Form 8949 for cryptocurrency?

2. Complete IRS Form 8949

- A description of the property you sold (a)

- The date you originally acquired the property (b)

- The date you sold or disposed of the property (c)

- Proceeds from the sale (fair market value) (d)

- Your cost basis for purchasing the property (e)

- Your gain or loss (h)

How do I get data from Binance in Excel?

Import Binance Data to Google Sheets

- Contents.

- Before You Begin.

- Part 1: Create Your API Request URL.

- Part 2: Pull Binance API Data into Sheets.

- Part 3: More Example Binance API URLs.

- Part 4: Handle Binance Timestamps.

- Part 5: Get Private Binance Account Data.

- Part 6: Binance Limits.

How do you use the Stockhistory function in Excel?

The Excel STOCKHISTORY function retrieves historical stock price information based on a given symbol and date range. The primary purpose of STOCKHISTORY is to get the history of a financial instrument over time.

Properties.

| Code | Value | Description |

|---|---|---|

| 5 | Volume | Volume traded during the period |

Can I connect Binance to Excel?

Access Binance in Excel. Binance is the biggest cryptocurrency exchange in the world. Use this connector in Excel to access public exchange information, as well as your personal trading data.

Can Google Sheets track crypto prices?

Step 1. Go to the CoinMarketCap website and click on the crypto you want to pull price information from. For example if you want to pull the price information for Bitcoin, then you need to go to the following page CoinMarketCap.com/currencies/bitcoin. Copy the url and past it into your google sheets document as such.

Does GOOGLEFINANCE work with crypto?

Google Finance, a data site maintained by the tech giant, now has a dedicated “crypto” field. And it has prominent placement, too. Right at the top of the page, where users can “compare markets,” crypto is listed among the five default markets, which also includes U.S., Europe, Asia and “Currencies.”

Can I use GOOGLEFINANCE for crypto?

First let’s go over the more simple method for pulling crypto prices into Google Sheets, which is by using the GOOGLEFINANCE function. With this method, all that you have to do is specify the cryptocurrency symbol for the criteria in the formula, and the formula will display the current price for that cryptocurrency.

Do you have to report crypto under $600?

If you earn $600 or more in a year paid by an exchange, including Coinbase, the exchange is required to report these payments to the IRS as “other income” via IRS Form 1099-MISC (you’ll also receive a copy for your tax return).

Do I need to file crypto taxes if I lost money?

Yes, you need to report crypto losses on IRS Form 8949. Many investors believe that if they only incur losses and no gains, that they don’t actually have to report this to the IRS. This is not true, and the IRS makes it clear that cryptocurrency losses need to be reported on your tax return.

What happens if you don’t report cryptocurrency on taxes?

If you don’t report taxable crypto activity and face an IRS audit, you may incur interest, penalties or even criminal charges. It may be considered tax evasion or fraud, said David Canedo, a Milwaukee-based CPA and tax specialist product manager at Accointing, a crypto tracking and tax reporting tool.

Do I have to report crypto gains 2021?

If you sold crypto and made money on it in 2021, you need to pay taxes on the gains. That’s why you should keep good records of all your crypto transactions. The U.S. government recently passed a bill that requires crypto exchanges to issue a Form 1099 for all their customers, starting with the 2023 tax year.

How do I get 8949 from Coinbase?

To download your Form 8949:

- Sign in to your Coinbase account.

- Click and select Taxes.

- Click Documents.

- Click Generate next to 2021 – Form 8949 (PDF).

- After it’s generated, click Download.

How do I report crypto interest?

Fill out your Form 8949

Once you gather all of the details of your cryptocurrency transactions during the tax year, start plugging them into Form 8949. That’s where you report all dispositions of capital assets, whether or not they generated taxable gains.

What tax forms do I need for crypto?

The IRS treats cryptocurrency as “property.” If you buy, sell or exchange cryptocurrency, you’re likely on the hook for paying crypto taxes. Reporting your crypto activity requires using Form 1040 Schedule D as your crypto tax form to reconcile your capital gains and losses and Form 8949 if necessary.

Can I connect Excel to Binance?

Access Binance in Excel. Binance is the biggest cryptocurrency exchange in the world. Use this connector in Excel to access public exchange information, as well as your personal trading data.

Which Cryptocurrencies are in Excel?

The currently available cryptocurrencies in Excel include:

- Bitcoin (BTC)

- Bitcoin Cash (BCH)

- Litecoin (LTC)

- Ripple (XRP)

- Ethereum (ETH)

Is Binance API data free?

Binance is a free source of crypto market data, e.g. coin prices, recent trades, exchange information and more. We will connect to Binance using the Data Fetcher app and create a crypto tracker in Airtable.