The general rule of thumb is that you should save 20% of your salary for retirement, emergencies, and long-term goals. By age 21, assuming you have worked full time earning the median salary for the equivalent of a year, you should have saved a little more than $6,000.

Furthermore, Is 10K in savings good?

Yes, saving $10K per year is good. It will make you a millionaire in 30 years and generate a passive income of $100K per year after 38 years (given a 7% annual return). I’m assuming that you’re investing your savings into a passive index fund (or something roughly equating it) with an annual average return of 7%.

Then, What is considered rich? Compared to 2021 standards, respondents to the 2020 survey described the threshold for wealth as being a net worth of $2.6 million.

Where should I be financially at 25? By age 25, you should have saved at least 0.5X your annual expenses. The more the better. In other words, if you spend $50,000 a year, you should have about $25,000 in savings. If you spend $100,000 a year, you should have at least $50,000 in savings.

Therefore, How much money should I have at 18? How Much Should I Have Saved by 18? In this case, you’d want to have an estimated $1,220 in savings by the time you’re 18 and starting this arrangement. This accounts for three months’ worth of rent, car insurance payments, and smartphone plan – because it might take you awhile to find a job.

How much money should a 24 year old have in savings?

Many experts agree that most young adults in their 20s should allocate 10% of their income to savings. One of the worst pitfalls for young adults is to push off saving money until they’re older.

How much is a lot of money?

Respondents to Schwab’s 2021 Modern Wealth Survey said a net worth of $1.9 million qualifies a person as wealthy. The average net worth of U.S. households, however, is less than half of that.

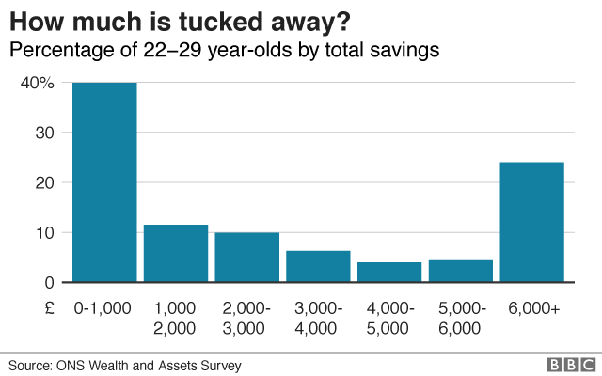

How much does the average 22 year old have in savings?

Of “young millennials” — which GOBankingRates defines as those between 18 and 24 years old — 72% have less than $1,000 in their savings accounts and 31% have $0. A sliver (8%) have over $10,000 saved.

What age can you retire with $2 million?

As a result, annual income need from your $2 million portfolio can be much higher from age 60 to 70. At least until you start taking social security. So, while two million dollars may seem like a lot, there are many hurdles to jump over in retirement to make sure your money lasts the rest of your life.

What is a good salary?

According to the census, the national average household income in 2019 was $68,703. A living wage would fall below this number while an ideal wage would exceed this number. Given this, a good salary would be $75,000.

How much money is a lot in savings?

Your age is one of many factors in your personal financial picture. Understanding how long before you expect to reach certain life stages (such as retirement) is an important part of saving money.

Average savings by age.

| Age group | Average savings balance |

|---|---|

| Under 35 | $11,200 |

| 35-44 | $27,900 |

| 45-54 | $48,200 |

| 55-64 | $57,800 |

• Mar 23, 2022

How much money does an average 22 year old have?

High Achiever Millennial Net Worth By Age

| Age | High Achiever Net Worth |

|---|---|

| 25 (Class of 2017) | $104,765 |

| 24 (Class of 2018) | $72,706 |

| 23 (Class of 2019) | $41,518 |

| 22 (Class of 2020) | $28,915 |

• Oct 23, 2021

How much money should a 20 year old have saved up?

As you get deeper into your 20s, you should shoot to have about one quarter of your annual cash (25% of your gross pay) saved up, according to a spokeswoman for the budgeting app Mint. That means that the typical 25-year old might want to have somewhere around $10,000 in savings. Curious about where you stand?

How much money should a 27 year old have?

Fast answer: A general rule of thumb is to have one times your annual income saved by age 30, three times by 40, and so on.

How much should I have saved 19?

While there may be some, they are few and far between. In short, a teenager should try and save $2000 a year from ages 15-20. Having $10,000 set aside at age 20 is a great foundation for any teenager to start their next phase of life with.

How could a 12 year old make money?

10 Ways for Preteens to Make Money This Summer

- Work as a ‘mommy’s helper’ In the past, middle-school-age baby sitters were the norm.

- Help a local senior. This was actually one of my earliest jobs.

- Open a lemonade stand. Ah, a lemonade stand.

- Do yard work.

- Walk dogs.

- Pet sit.

- Provide tech support.

- Wash cars.

Where should I be financially at 30?

Created with sketchtool. By 30, you should have a decent chunk of change saved for your future self, experts say — in fact, ideally your account would look like a year’s worth of salary, according to Boston-based investment firm Fidelity Investments, so if you make $50,000 a year, you’d have $50,000 saved already.

What salary is rich?

With a $500,000+ income, you are considered rich, wherever you live! According to the IRS, any household who makes over $500,000 a year in 2022 is considered a top 1% income earner. Of course, some parts of the country require a higher income level to be in the top 1% income, e.g. Connecticut at $580,000.

How much is wealthy?

The average net worth needed to be considered wealthy and to be financially comfortable both rose from last year’s survey. In 2021, Americans said they needed $624,000 in net assets to live comfortably, while it would take $1.9 million to be rich.

Is 200000 a year good?

If you earn a $200,000 salary, you’re in the top 10% of earners in the United States.

What should your net worth be at 27?

According to CNN Money, the average net worth in 2022 for the following ages are: $9,000 for ages 25-34, $52,000 for ages 35-44, $100,000 for ages 45-54, $180,000 for ages 55-64, and $232,000+ for 65+.

How long will 500k last?

If you have $500,000 in savings, according to the 4% rule, you will have access to roughly $20,000 per year for 30 years. Retiring abroad in a country in South America may be more affordable in the long term than retiring in Europe.

Can I retire at 60 with 500k?

The short answer is yes—$500,000 is sufficient for some retirees. The question is how that will work out. With an income source like Social Security, relatively low spending, and a bit of good luck, this is feasible.

Can I retire at 55 with $600000?

It’s possible to retire with $600,000 in savings with careful planning, but it’s important to consider how long your money will last. Whether you can successfully retire with $600,000 can depend on a number of factors, including: Your desired retirement age. Estimated retirement budget.