The short answer is no. You don’t need a business license to sell products online including Amazon. This is because most products that are being sold on Amazon are not Federally regulated. In general, most products sold online are consumer products that don’t require the governments approval.

Accordingly, What documents do I need to sell on Amazon?

Before you sign up, make sure you’re ready with the following:

- Business email address or Amazon customer account.

- Internationally chargeable credit card.

- Government ID (identity verification protects sellers and customers)

- Tax information.

- Phone number.

- A bank account where Amazon can send you proceeds from your sales.

as well, Does Amazon collect tax? Amazon calculates, collects, and remits tax on sales made by merchants shipped to customers located in the states that have enacted Marketplace Facilitator, Marketplace Fairness, or similar laws. These laws shift collection responsibility from the merchant to the marketplace facilitating the merchant’s sale.

What is FBA Amazon? Fulfillment by Amazon (FBA) is a service that helps businesses grow by providing access to Amazon’s logistics network. Businesses send products to Amazon fulfillment centers and when a customer makes a purchase, we handle receiving, packing, shipping, customer service, and returns for those orders.

So, Can I sell on Amazon as an individual? The Individual selling plan is a pay-as-you-go plan that provides access to a basic set of listing and order management tools. Individual sellers can create listings one at a time by matching their products to existing pages or creating new pages in the Amazon catalog.

How long does it take to get approved as an Amazon seller?

How Long Does it Take to Verify Your Amazon Seller Account? In most cases, your account will be approved within 24 hours. However, if there’s a problem with any of your information, or you entered it incorrectly, this can delay the process.

Do I need to file taxes if I sell on Amazon?

The short answer is yes. You need to report your Amazon sales as income on your taxes, just like your other income streams. That’s why tax season is not when you need to get everything together for your Amazon FBA business.

Is it a good idea to be a seller on Amazon?

In short: yes. But let’s go over why. In 2021, Amazon’s revenue was a whopping $469 billion, up from $386 billion in 2020 — and nearly one quarter (22%) of that revenue is driven by third-party sellers! Of those third-party sellers, 89% of them use Fulfillment by Amazon (FBA) to manage their Amazon business.

How do I avoid Amazon taxes?

Our Amazon Tax Exemption Program (ATEP) supports tax-exempt purchases for sales sold by Amazon, its affiliates, and participating independent third-party sellers. The Amazon Tax Exemption Wizard takes you through a self-guided process of enrollment. Go to the Tax Exemption Wizard.

Do I have to report Amazon sales on my taxes?

The short answer is yes. You need to report your Amazon sales as income on your taxes, just like your other income streams. That’s why tax season is not when you need to get everything together for your Amazon FBA business.

How much tax does Amazon take out of your paycheck?

Over the past three years, Amazon paid an effective federal income tax rate of just 4.3 percent on U.S. income. Over the past 10 years, Amazon’s effective federal tax rate on $57 billion of U.S. pretax income was just 4.7 percent, especially remarkable given that the legal rate was 35 percent for most of this period.

Can Amazon FBA make you rich?

If you work hard enough, you might join the upper 6% of people earning more than $250,000 a month in sales. Take into account that on average, they spend less than 30 hours a week on their business and you will see that yes, Amazon FBA can make you rich!

Is Amazon FBA worth it 2021?

The short answer is- yes, it’s still profitable to start Amazon FBA in 2021. Despite many negative opinions talking about the oversaturated market, it’s still a good idea to try your own Amazon business.

How much does it cost to ship to FBA?

How much is Amazon FBA?

| Fee type | Price |

|---|---|

| FBA fulfillment fees (per unit) – Standard size | From $2.41 to $4.71+ (cost depends on weight) |

| FBA fulfillment fees (per unit) – Oversize | From $8.13 to $137.32+ (cost depends on size classification) |

| Inventory removal (per unit) – Return | From $0.50 to $0.60 depending on item size |

• Nov 2, 2018

How much does Amazon sellers make?

Most Amazon sellers make at least $1,000 per month in sales, and some super-sellers make more than $100,000 each month in sales. 50% of Amazon sellers make $1,000 to $25,000/month, which could mean $12,000 to $300,000 in annual sales.

Is Amazon FBA a good idea?

FBA is indeed a really handy service, but it costs money. That’s money that some people might not have to spend just yet. Plus, this service isn’t good for low-cost items because of the way fees are calculated, so you’ll want to be selective about products you enroll.

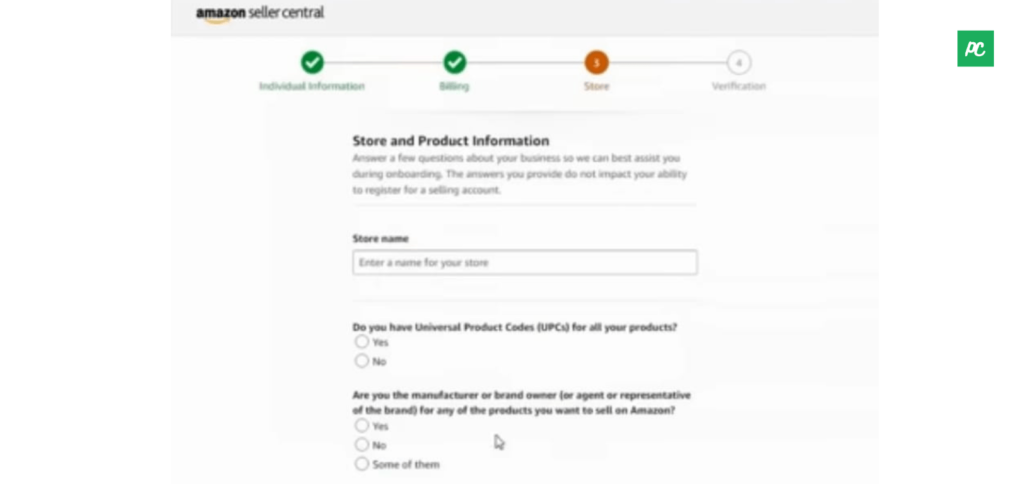

How do I create an Amazon 2021 seller account?

What does approval needed mean on Amazon?

Best Answer: This means that Amazon is not comfortable selling the product in question and needs some assurance that it is a quality product that will meet customer expectations.

How do I change my Amazon account to a business account?

Select Settings and Switch Accounts . Select Manage . Select X located on the top right hand corner of each account . Select Sign Out .

To switch accounts:

- Select the menu button in the app.

- Select Settings and Switch Accounts.

- Select Add Account to add a business account.

- Sign in and start shopping.

Do Amazon sellers pay tax?

All sellers making money on Amazon are required to pay Income Tax and Amazon Sales Tax. There are several forms sellers need to consider when filing taxes: 1099-K form (sales tax and shipping fees);

Do Amazon sellers collect sales tax?

Amazon calculates, collects, and remits tax on sales made by merchants shipped to customers located in the states that have enacted Marketplace Facilitator, Marketplace Fairness, or similar laws. These laws shift collection responsibility from the merchant to the marketplace facilitating the merchant’s sale.

Do you need tax ID to sell Amazon?

Amazon requires that all sellers complete the U.S. Tax Identity Information Interview. You can provide your taxpayer identification information to Amazon by clicking here to use our self-service Tax Interview process that will guide you through entering your taxpayer information and validating your W-9 or W-8BEN form.

Do I need a website to sell on Amazon?

Brand recognition — People trust Amazon, but many are wary of buying from other sites that they’ve never used before. Don’t need a website — While you can also have a website in addition to selling on Amazon, you can start a business selling only through Amazon with no website of your own.

What are the disadvantages of Amazon?

Amazon’s limitations/Disadvantages

- Amazon’s Customer Loyalty.

- No Data Access for Amazon Sellers.

- Amazon limits your brand.

- Amazon FBA takes control of your business.

- Amazon could take advantage of your success.