Finding profit is simple using this formula: Total Revenue – Total Expenses = Profit.

Accordingly, How do you calculate net profit margin percentage?

Formula and Calculation for Net Profit Margin

On the income statement, subtract the cost of goods sold (COGS), operating expenses, other expenses, interest (on debt), and taxes payable. Divide the result by revenue. Convert the figure to a percentage by multiplying it by 100.

as well, How do you calculate margin and markup? Markup is the percentage of the profit that is your cost. To calculate markup subtract your product cost from your selling price. Then divide that net profit by the cost. To calculate margin, divide your product cost by the retail price.

How do I calculate profit margin in Excel? The formula should divide the profit by the amount of the sale, or =(C2/A2)100 to produce a percentage. In the example, the formula would calculate (17/25)100 to produce 68 percent profit margin result.

So, How do you calculate margin on a product? The difference between the selling price and the product cost gives the product’s gross profit margin. To obtain the product margin, the gross profit margin is divided by the selling price. Product margin= (selling price – cost of product) / selling price.

How do you calculate profit margin quizlet?

The equation to calculate net profit margin is: net margin = net profit / revenue.

How do you calculate profit markup?

Profit = revenue – cost . So the markup formula becomes: markup = 100 * (revenue – cost) / cost . And finally, if you need the selling price, then try revenue = cost + cost * markup / 100 .

What do you mean by profit margin?

Profit margin gauges the degree to which a company or a business activity makes money, essentially by dividing income by revenues. Expressed as a percentage, profit margin indicates how many cents of profit has been generated for each dollar of sale.

How does a company calculate net profit?

Since net profit equals total revenue after expenses, to calculate net profit, you just take your total revenue for a period of time and subtract your total expenses from that same time period. Here’s an example: An ecommerce company has $350,000 in revenue with a cost of goods sold of $50,000.

What is profit margin quizlet?

Profit margin measures the extent by which selling price covers all expenses.

What is the formula to calculate selling price?

How to Calculate Selling Price Per Unit

- Determine the total cost of all units purchased.

- Divide the total cost by the number of units purchased to get the cost price.

- Use the selling price formula to calculate the final price: Selling Price = Cost Price + Profit Margin.

What is a good margin of profit?

But in general, a healthy profit margin for a small business tends to range anywhere between 7% to 10%. Keep in mind, though, that certain businesses may see lower margins, such as retail or food-related companies.

What is a good profit margin for a product?

You may be asking yourself, “what is a good profit margin?” A good margin will vary considerably by industry, but as a general rule of thumb, a 10% net profit margin is considered average, a 20% margin is considered high (or “good”), and a 5% margin is low.

What is a good net profit margin?

An NYU report on U.S. margins revealed the average net profit margin is 7.71% across different industries. But that doesn’t mean your ideal profit margin will align with this number. As a rule of thumb, 5% is a low margin, 10% is a healthy margin, and 20% is a high margin.

What does a 10 profit margin mean?

10 or 10 percent, meaning that each dollar of sales generated an average of ten cents of profit. Thus, the profit margin is very important as a measure of the competitive success of a business, because it captures the firm’s unit costs. A low-cost producer in an industry would generally have a higher profit margin.

What is the difference between the profit margin and the gross profit rate quizlet?

The gross profit rate is computed by dividing net sales by gross profit and the profit margin is computed by dividing net sales by net income. The gross profit rate will normally be higher than the profit margin ratio. The gross profit rate will normally be higher than the profit margin ratio.

Do you want a high gross profit margin?

A higher profit margin is always desirable since it means the company generates more profits from its sales. However, profit margins can vary by industry. Growth companies might have a higher profit margin than retail companies, but retailers make up for their lower profit margins with higher sales volumes.

What is formula of profit and loss?

What is the profit and loss formula? The formula for profit = Selling price – Cost price. Profit % = (Profit/Cost price) x 100. The formula for loss = Cost price – Selling price. Loss % = (Loss/Cost price) x 100.

How do you calculate small business profit?

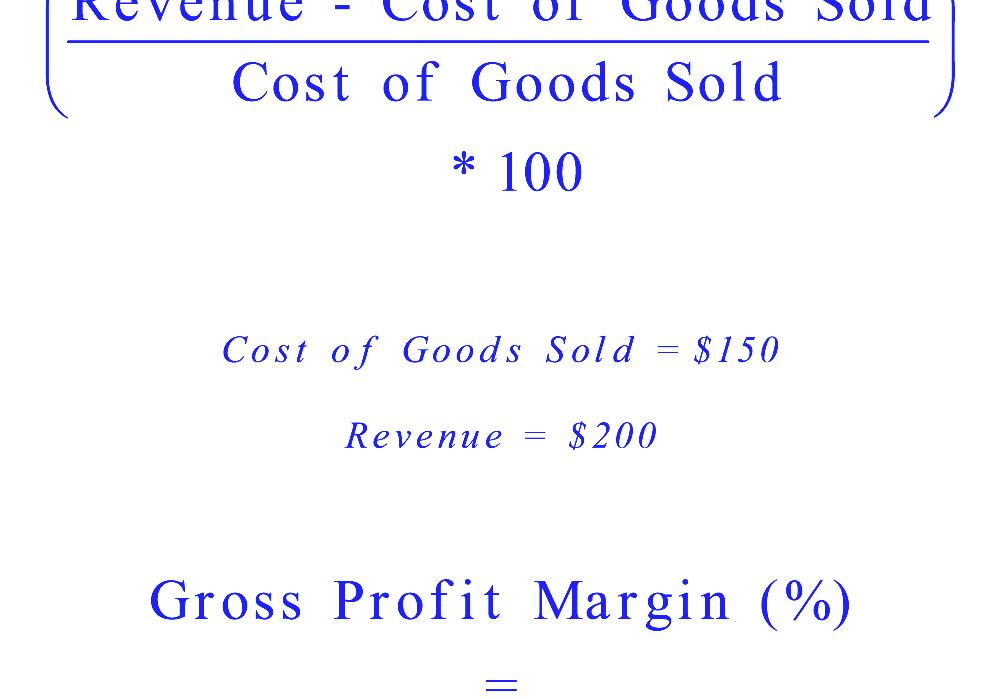

To calculate the Gross Profit Margin for your startup or small business, take the revenue and minus the direct costs of producing your product. Divide this by the revenue. The resulting number is multiplied by 100 and the answer is expressed as a percentage. This is your Gross Profit Margin.

How do you calculate margin percentage on a product?

To find the margin, divide gross profit by the revenue. To make the margin a percentage, multiply the result by 100.

How much profit should I take from my business?

A safe starting point is 30 percent of your net income.

If you have an accountant or tax preparer, ask them what percentage of your net income you should save for taxes. Since they’ll know your unique tax situation, they can give you a more accurate percentage.

Why do we calculate net profit margin?

This profitability ratio shows what percentage of every dollar of sales becomes profit. For example, a company making a 45-percent net profit margin earns 45 cents of profit for each dollar of sales revenue. Net profit margin is a useful indicator of a company’s overall profitability and financial health.

What is the difference between the profit margin ratio and the gross profit rate?

Key Takeaways. Gross profit describes a company’s top line earnings; that is, its revenues less the direct costs of goods sold. The gross profit margin then takes that figure and divides it by revenue to get a handle on how much gross profit is generated on a percentage basis after taking costs into account.

What is the gross profit rate?

Gross profit is a calculation that indicates how much of every sales dollar represents revenues minus inventory cost. Gross profit equals net sales after cost of goods sold is deducted but before other selling and administrative costs are deducted. From gross profit, managers can calculate gross profit rate.

What does the gross profit percentage tell you quizlet?

The gross profit percentage measures the percentage of profit earned on each dollar of sales before deducting all expenses other than cost of goods sold.