OnlyFans’ business model is straightforward. They provide a platform for paywalled content. Creators make and post exclusive content, for which their subscribers pay.

Furthermore, How does OnlyFans business work?

OnlyFans makes money by taking a cut from subscriptions or tips as well as by selling merchandise through its e-commerce store. OnlyFans is largely built on a subscription-based business model. Customers pay a monthly fee in order to access exclusive content by its creators.

Then, What are the requirements for OnlyFans? Fans and creators must be 18 years old, and not include anyone under that age in their content. They must only use their accounts for a lawful purpose. The acceptable use information in the OnlyFans terms of service sets out clearly what is allowed on the platform, and more importantly, what isn’t.

Can you still make money on OnlyFans 2021? Paid posts

If you have a free OnlyFans account, you can still make money. In fact, many creators are able to earn a living from their free accounts. One of the ways to do this is to put some of your posts behind a paywall, and this is a really effective way to add exclusivity to your content.

Therefore, Should I register my OnlyFans as a business? Forming an LLC for OnlyFans helps protect your privacy. There are additional tax benefits, for example making your computer, camera, phone and other items business expenses, but we believe privacy is the most important. This applies whether you’re using OnlyFans or any other cam service, e.g. Myfreecams, Mystar etc.

Do I need an LLC for OnlyFans?

The short answer is no, you do not necessarily need an LLC for your Only Fans, but you will want to find a way to separate your business income from your personal income and protect your personal assets with limited liability.

Does OnlyFans count as small business?

If you are an OnlyFans girl or guy earning income through the content subscription service, then you’ll need to file your independent contractor taxes at the end of the year. An OnlyFans content creator is considered self-employed.

Is OnlyFans legal income?

This makes your tax life very simple, you are what the IRS considered self-employed and what you will receive is most likely a onlyfans 1099 form, which will indicate your total earnings for the year. But don’t panic if you don’t get one. They will only send you one if you earned more than $600 in earnings this year.

Can I sue OnlyFans for not paying me?

Yes, you can sue, but good luck tracking her down, let alone getting her to pay even if you win

Is OnlyFans a sole proprietor?

If you’re an OnlyFans or Myystar creator, that means that you are in business for yourself. You are NOT an employee of OnlyFans or Myystar, you are a sole proprietor running your own business.

Can employers see OnlyFans on taxes?

Yes, your OnlyFans account can show up on a background check if the prospective employer ran a comprehensive check, and you have received a 1099 tax form from OnlyFans.

How do I file OnlyFans on my taxes?

Onlyfans will not send you any sort of income document so you just use your own records of how much you made. You are an “independent contractor” to the IRS. You will be able to use the Free File software so that you do not have to pay for tax preparation.

How much do you have to make on OnlyFans to get taxed?

Earning from OnlyFans is normally considered self-employment, and according to it, it is common practice to file a 1099 form if you earn more than $600 per year in the United States.

Will OnlyFans show up on my taxes?

In the United States, anyone who makes a yearly income of $600 is subject to paying taxes by filing a 1099 form. OnlyFans will issue you these around tax time. These forms are provided to those who have earned self-employment income.

Do you get a W2 from OnlyFans?

You will not receive a W2 at the end of the year. You will receive a 1099NEC form that reflects the total amount OnlyFans or Myystar paid you during the year in box 1.

Can OnlyFans know if you screenshot?

The platform currently has no way of knowing if you take a screenshot on PC, iPhone, Android device, or tablet. The reason Onlyfans has no way of telling if a screenshot is taken is due to it being a web-based app.

How do you make money on OnlyFans without showing your face?

You don’t have to show your face to make money on the site. The best way to hide and maintain an anonymous OnlyFans account is to come up with a character for your presence on the Internet. You can use a fictitious name or even a nickname. Such pages on OnlyFans are quite common.

Is OnlyFans going to court?

Instagram models Sarah Stage and Jessica Quezada are the latest creators to sue OnlyFans management company Unruly, accusing it of pressuring them to do more explicit content and wrongfully sharing sexual materials and sending sexual messages to fans.

Are you self-employed with OnlyFans?

If you’re an OnlyFans or Myystar creator, that means that you are in business for yourself. You are NOT an employee of OnlyFans or Myystar, you are a sole proprietor running your own business.

How do I prove my income OnlyFans?

print out your tax form or send screenshots of it to their email! i had to do that, print out 3 months of bank statements, and screenshot the actual graph where we can put the date in to show how much we’ve made in that time period. or offer 3 months rent up front!

Do you need a w9 for OnlyFans?

When you create an OnlyFans or Myystar account to become a creator, they are going to require you to fill out a form W-9. If you look at your screen or if you’re reading the memo you’ll see a copy of one. Some of you may never have filed a tax return before, so this entire process can be very intimidating.

Can a background check find OnlyFans?

A recent comment on the ClearanceJobsBlog site asks if they can create an OnlyFans account – and not have their employer find out about it. It’s not something that can be kept out of the background investigations process.

Can you do OnlyFans without showing your face?

The short answer: yes. You can be able to make money without showing your face. However, there are some caveats that you need to pay attention to. It may depend on the parts of your body that may appear aesthetically pleasing.

What does OnlyFans look like on bank statement?

How do you prove income OnlyFans?

print out your tax form or send screenshots of it to their email! i had to do that, print out 3 months of bank statements, and screenshot the actual graph where we can put the date in to show how much we’ve made in that time period. or offer 3 months rent up front!

What type of business is OnlyFans?

OnlyFans is a content subscription-based service that brings creators and influencers in direct contact with the consumers of their content or their ‘fans’. It is a social media platform that helps them earn directly by satisfying their audience’s requirements and thus, ‘monetise their influence’.

Does OnlyFans send you a 1099 in the mail?

As an OnlyFans independent contractor, you are responsible for keeping track of your earnings and accurately reporting them in tax filings. If you earned more than $600, you’ll receive a 1099-NEC form.

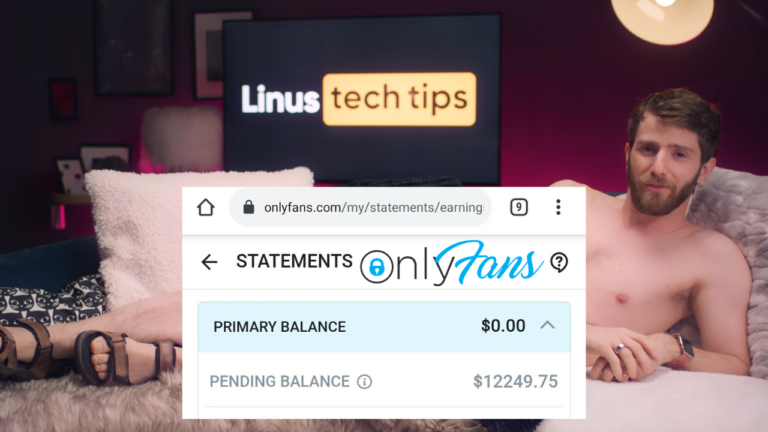

How do I cash out on OnlyFans?

How To Cash Out. When performers make their OnlyFans accounts, they link their bank accounts to their profile, the same way you’d do with Venmo or PayPal. If you set up an automatic recurring payment, your earnings will transfer directly into your linked bank account.