CLV encourages better decision making by teaching marketers to spend less time acquiring customers with lower value. And the bottom line? Effective management of your customers relationships, which leads to increased profitability—that’s perhaps the most obvious advantage of Customer Lifetime Value.

Accordingly, How will a company boost its CLV?

– upselling is one of the easiest ways to raise your CLV. Upselling and cross-selling (which is similar, but not the same) are two simple, effective ways to increase the amount of money your customers spend on your business. Upselling is the art of selling a more expensive version of a specific product or service.

as well, How do you take CLV? Here are some actionable ways to use your customer lifetime value.

- Benchmark Your Efforts. Let’s start with the most basic way to use your CLV.

- Decide where to Invest for CLV Growth.

- Discover Your Most Profitable Acquisition Channel.

- Discover Your Most Profitable Customer.

- Handle Customer Complaints.

What is a good CLTV? Your product pricing, cost of goods, and churn rate are represented in the CLTV. This ratio is a simple number that can be measured internally and against peers. Generally, it’s accepted that a CLTV : CAC ratio of 3 or higher is healthy.

So, Is customer lifetime value a vanity metric? Instead, when looking to measure ROI, focus on metrics that allow you to enhance the volume and quality of your conversions such as customer lifetime value (CLTV). This metric is not a vanity metric.

What are the 4 types of utility in marketing?

There are four types of economic utility, which include form, time, place, and possession. Companies that can understand and recognize areas that are lacking in their marketing schemes can assess consumer purchase decisions and pinpoint the drivers behind those decisions, thus boosting their sales and profits.

How do you grow CLV?

3 Proven Ways To Increase eCommerce Customer Lifetime Value (CLV)

- Offer A Memorable Customer Experience. One of the fastest ways to increase your customer lifetime value is by constantly improving the customer experience your business offers.

- Create A Customer Loyalty Program.

- Engage Customer With Email Marketing.

How do you calculate CLV in Excel?

How is LTV calculated?

Understanding the Loan-to-Value (LTV) Ratio

An LTV ratio is calculated by dividing the amount borrowed by the appraised value of the property, expressed as a percentage. For example, if you buy a home appraised at $100,000 for its appraised value, and make a $10,000 down payment, you will borrow $90,000.

How do you use Cltv?

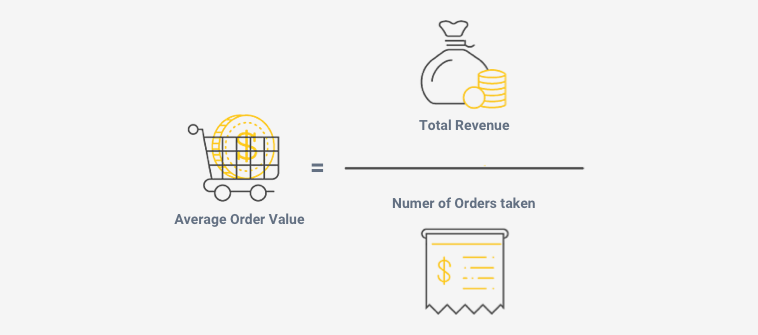

There are few approaches available to compute CLTV. Let’s use some simple equations: Customer Value = Average Order Value (AOV)* Purchase Frequency .

- Churn Rate: Churn Rate is the % of customers who have not ordered again.

- Customer Lifetime = 1/ churn rate.

- Churn Rate= 1-Repeat Rate.

What does 80% CLTV mean?

The CLTV ratio is determined by adding the balances of all outstanding loans and dividing by the current market value of the property. For example, a property with a first mortgage balance of $300,000, a second mortgage balance of $100,000 and a value of $500,000 has a CLTV ratio of 80%.

What is the difference between CLTV and LTV?

The loan to value (LTV) ratio of a mortgage is the ratio of the mortgage balance to the value of the property, while the combined loan to value (CLTV) is the same calculation made for the sum of all loans taken out on the property.

What is a good CLTV rate?

Lenders use the CLTV ratio to determine a prospective home buyer’s risk of default when more than one loan is used. In general, lenders are willing to lend at CLTV ratios of 80% and above to borrowers with high credit ratings.

Which KPI is a vanity metric?

What Are Vanity Metrics? Vanity metrics include data such as social media followers, page views, subscribers, and other flashy analytics that are satisfying on paper, but don’t move the needle for your business goals.

Why are vanity metrics bad?

The reason vanity metrics are so decried is that they’re overly simplistic to measure, they skip nuance and context, they are often misleading, and they don’t really help you improve in any meaningful way.

What is a KPI metric?

KPIs or Key Performance Indicators are the metrics by which you gauge business critical initiatives, objectives, or goals. The operative word in the phrase is “key,” meaning they have special or significant meaning. KPIs act as measurable benchmarks against defined goals.

What are the 7 marketing functions?

Such functions describe all things that form parts of the marketing practice. We’re going to take a closer look at the seven major functions of marketing in this article. Marketing’s seven functions are distribution, market research, pricing, finance, product management, promotional channels, and consumer matching.

What are the 6 types of utility?

Types of Utility:

- (1) Form Utility:

- (2) Place Utility:

- (3) Time Utility:

- (4) Service Utility:

- (5) Possession Utility:

- (6) Knowledge Utility:

- (7) Natural Utility:

- Utility and Usefulness:

What are the 5 utilities of marketing?

The Five Types of Utility in Marketing

- Utility of Time. This is the “when” component of utility: Is your product available when customers want it?

- Utility of Place. Place utility refers to the ability of consumers to get what they want, where they want it.

- Utility of Possession.

- Utility of Form.

- Utility of Information.

What is implementing CLV?

Customer LifeTime Value (CLV) is an important metric used in ecommerce industry to make a smart investment decision in marketing and identify/nurture the high value customers. The primary objective of measuring the CLV is to improve the following key metrics; the average shopping frequency of the customer.

What was the best thing you did that boost your CLV?

Upselling and cross-selling are some of the most fundamental techniques to improve your CLV, and in turn, your revenue. Introducing upsells and cross-sells in your marketing program increases your sales volume almost immediately, and it just might be the easiest method to grow your revenue.

How do you calculate CLV and CAC?

The relationship between CAC and CLV

Allowing that margin to get too slim can result in some serious stability issues. A simple formula for calculating CLV is this: “Annual revenue per customer times customer relationship in years minus customer acquisition cost.”

What is Lifetime NPV?

NPV compares the present value of the cash flows at the required rate of return (also called the discount rate) of your project to your initial investment to determine whether to make the investment.

What is a customer lifetime value CLV and how is it estimated?

Customer lifetime value (CLV, or CLTV) is a metric that indicates the total revenue a business can reasonably expect from a single customer account throughout the business relationship. The metric considers a customer’s revenue value and compares that number to the company’s predicted customer lifespan.