Square Cons:

- Not ideal for big companies with huge transactions.

- Some account stability issues.

- Not suitable for high-risk industries.

- High fees for large businesses.

Accordingly, Does Square offer buyer protection?

That is, when buyers choose to dispute their charges with the business in question, Square will cover those chargebacks for free – up to $250 per month, the company notes.

as well, Can you get scammed on Square? If you believe you called a fraudulent number for Square or if you receive a suspicious phone call, do not provide any personal or account information, and hang up immediately. If you receive a suspicious email regarding Square, don’t reply to the message, select any links, or open any attachments.

Why you shouldn’t use Square? Square has oversimplified credit card processing. This has allowed the company to grow rapidly, but at the expense and frustration of many of its users in the form of deposit limits, frozen funds, and poor customer service. That’s not to say you shouldn’t use Square.

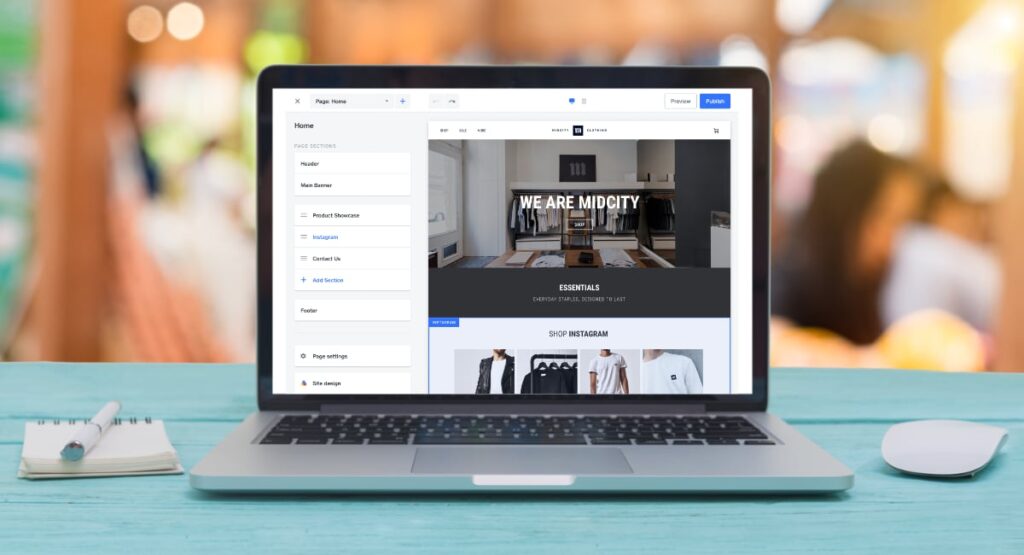

So, What is the difference between Square and Shopify? Square and Shopify offer payment processing services that support in-person and online sales and include point-of-sale, or POS, software features. But they differ in pricing, contract requirements and features. While Shopify might be better suited for focusing on e-commerce sales, Square offers more flexibility.

Is Square safe for the seller?

Your payments are encrypted to protect from hackers. It’s all designed and maintained by Square so you don’t have to go through anybody else. Payments are secure out of the box with no lengthy setup. All card-present payments are encrypted from end to end.

Can I get my money back from Square?

Payments processed on Square Online are only eligible to refund within 120 days. Note: Refund requests that aren’t covered by your Square balance may not be approved, even if requested within the appropriate time frame.

Why is Square taking money out of my account?

Square may debit a bank account for one of the following reasons: You process a refund. A cardholder disputes a payment by issuing a chargeback.

Does Square protect sellers?

Square’s chargeback protection program offers merchants protection on up to $250 in eligible sales each month. Square will also waive chargeback fees and cover the costs of eligible chargebacks at no cost to the merchant — with a few conditions, of course. The items/services in question are eligible for protection.

How do I get my money back from Square?

Issue a Return From your Dashboard

- Log in to Reporting > Transactions tab in your online Square Dashboard.

- Click on the payment you’d like to refund, then click Issue Refund.

- Enter the amount you’d like to refund and the reason you’re refunding the payment, then click Issue Refund.

Is Square good for small businesses?

Square’s affordable and user-friendly payment processing is one of the best merchant services available for small businesses. In addition to mobile and in-store payments, every free Square account comes with a virtual terminal, invoicing, online payments, and tools to monitor and dispute chargebacks.

Does Square take a percentage of sales?

Square’s standard processing fee is 2.6% + 10¢ for contactless payments, swiped or inserted chip cards, and swiped magstripe cards. Payments that are manually keyed-in, processed using Card on File, or manually entered using Virtual Terminal have a 3.5% + 15¢ fee.

Does Square charge a monthly fee?

Overall, there is no monthly fee for using the basic Square POS app, and instead, you’ll only pay the standard 2.6% + $0.10 transaction fee for accepting in-person payments. The Square fees you pay will depend on the software you use and how you accept payments—plus, the one-time cost of any hardware you require.

Is it Squareup better than Shopify?

Square Online provides better value for money than Shopify

Shopify doesn’t offer bad value, but Square Online’s free plan and cheap starting price of $12 per month is difficult to beat. Square Online is perfect for sellers on a budget – it’s more affordable, if less scalable, than Shopify’s price plans.

Is Shopify owned by Square?

There is not a Square Shopify integration, but it’s simple to switch from Shopify to Square for your in-person and eCommerce platform.

Who owns Square Online?

Block, Inc.

| Type | Public |

|---|---|

| Area served | United States, Canada, Australia, Japan, United Kingdom, Ireland, France, Spain |

| Key people | Jack Dorsey (Chairman, CEO) Jim McKelvey (Director) Amrita Ahuja (CFO) |

| Products | Point of sale terminals and auxiliary equipment, debit cards |

| Services | Cash App Square |

Why did my money disappear on Square?

There’s a number of reasons why you might not be able to use instant transfers: You haven’t linked a bank account to Square, or your bank account isn’t completely verified. Your current balance is below the minimum transfer amount after fees: $25 minimum for instant transfers and $1 minimum for same-day transfers.

Why is Square holding my money for 90 days?

According to the businesses, Square said it could hang onto the money for up to four months and told them that it was doing this to protect against risky transactions or customers who demanded their money back.

How much is Square processing fee?

Square’s standard processing fee is 2.6% + 10¢ for contactless payments, swiped or inserted chip cards, and swiped magstripe cards. Payments that are manually keyed-in, processed using Card on File, or manually entered using Virtual Terminal have a 3.5% + 15¢ fee.

What is the difference between PayPal and Square?

One of the biggest differences between these two companies’ POS systems is that Square offers more business tools, such as employee management, while PayPal’s features are limited to payment. Square has a feature to schedule appointments within the app so that you can integrate your calendar with your payment platform.

Why is Square holding my money?

Why are my transfers suspended? Your transfers are likely suspended because we noticed some unusual activity on your Square account. Our system periodically reviews your transactions to keep your account safe from scams and fraud.

How long does Square take to deposit money?

All Square merchants start with our standard transfer schedule. With this schedule, funds are usually transferred within 36 hours or 1-2 business days of a transaction.

Which bank does Square use?

Square Checking is provided by Sutton Bank, member FDIC. Square Debit Card is issued by Sutton Bank, Member FDIC, pursuant to a license from Mastercard International Incorporated, and may be used wherever Mastercard is accepted.

Do I need a business bank account for Square?

No, Square requires a transactional bank account that allows for transfers and withdrawals in case of refunds or chargebacks. Prepaid cards or online-only accounts, like PayPal, aren’t supported.